Europe’s Slow Lane to AI Dominance: A Hidden Strategic Advantage

While the United States and China continue their high-speed collision course for artificial intelligence dominance, fueled by trillion-dollar investments and deregulation, Europe has seemingly chosen the scenic route. Critics, including top economists at the ECB, have long warned that this “slow and steady” pace risks leaving the continent in the digital dust.

However, a closer look reveals that Europe’s measured approach might not be a bug, but a feature. As the initial hype of generative AI settles and the world grapples with energy bottlenecks, hallucinating models, and regulatory chaos, Europe’s strategy of “regulation-first” and “industrial precision” is emerging as a formidable long-term edge.

The Stability Premium

In Silicon Valley, the motto has often been move fast and break things. In Brussels, it is move carefully and fix things first.

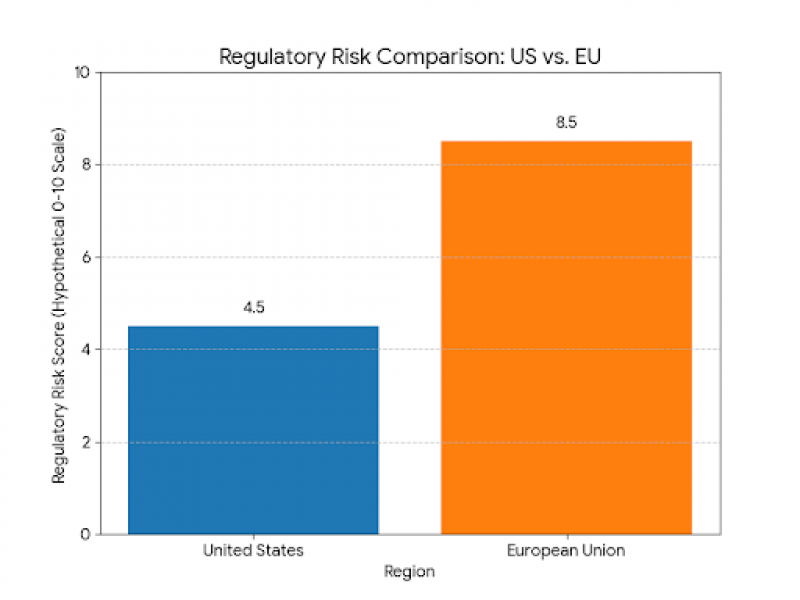

The rollout of the EU’s landmark AI Act was initially met with groans from tech giants fearing red tape. Yet, as 2025 draws to a close, that same regulatory framework is offering something the rest of the world lacks: certainty.

While US companies navigate a patchwork of state-level laws and looming antitrust battles, European enterprises operate within a clear, unified rulebook. This stability is becoming a magnet for global capital seeking a safe harbor for AI deployment, particularly in high-risk sectors like healthcare, finance, and autonomous transport, where safety cannot be an afterthought.

Converting Constraints into Innovation

One of the most surprising drivers of Europe's potential edge is its struggle with infrastructure. As reported recently, grid congestion and strict sustainability targets have prevented the construction of massive, power-hungry data centers at the scale seen in Texas or Inner Mongolia.

Rather than defeating Europe’s AI ambitions, these constraints are forcing a unique kind of innovation. European startups and established industrial titans like Siemens and SAP are pivoting away from brute-force Large Language Models toward highly efficient Small Language Models (SLMs) and specialized AI.

- SLMs require significantly less energy

- They operate efficiently on local hardware

- They are trained on high-quality industrial datasets, not noisy open-internet text

In a world increasingly worried about the carbon footprint of AI, Europe’s forced efficiency could become the global gold standard.

The B2B Giant Wakes Up

Europe has never been about consumer social media apps. Its strength lies in deep tech and heavy industry. The “slow” adoption allowed European firms to skip the “vaporware” phase of AI and integrate mature technologies directly into complex manufacturing and engineering workflows.

While the US dominates the chatbot market, Europe is quietly building the “industrial brain” AI that:

- Manages power grids

- Optimizes supply chains

- Accelerates pharmaceutical drug discovery

- Enhances precision engineering across factories

This B2B-focused AI ecosystem may lack the viral headlines of a new image generator, but it promises deeper, more sustainable economic value.

_1764246616.png)

A Marathon, Not a Sprint

The race for AI is a marathon, not a sprint. By prioritizing trust, energy efficiency, and industrial application over raw speed and scale, Europe is betting that the future of AI belongs not to the fastest runner, but to the one who doesn’t burn out halfway.

As the “wild west” era of AI faces its first major corrections, Europe’s slow lane is looking increasingly like the smart lane.

AI Valuation Fears and European Market Impact. This video provides critical context on the financial realities facing European markets, complementing the article's discussion on how economic factors are shaping the region’s unique AI strategy.

Post Comment

Be the first to post comment!