Why software visibility has shifted away from your website

For a long time, software visibility followed a predictable path. Buyers searched, landed on vendor websites, skimmed feature pages, and booked demos. That path still exists, but it no longer dominates how decisions form.

Today, buyers increasingly triangulate. They look for vendor claims on websites, but they validate those claims elsewhere. Review platforms, software directories, and comparison sites have become the spaces where buyers check whether a product is real, credible, and worth time.

This is where conversations around how to boost your software’s visibility with a "site Name" listing and where it should live have become more strategic. Listings are no longer a secondary SEO tactic. They sit directly inside the research phase, often before a buyer ever speaks to sales.

What a software listing really represents to a buyer

A software listing is not just a profile. It is a neutral frame of reference.

On directories and review platforms, your product is presented alongside alternatives, evaluated under shared criteria, and exposed to user commentary you do not fully control. For buyers, that context matters more than polish.

Listings work because they answer three questions buyers care about early:

Is this tool legitimate. Is it used by people like me. And how does it compare when stripped of marketing language.

That is why listings create a different type of visibility than ads or blog traffic. They do not introduce your product. They test it.

Why listings influence outcomes more than awareness

Software directories concentrate high-intent traffic. People browsing these platforms are not casually exploring. They are already aware of the problem and are actively narrowing options.

Appearing in the right category at the right time can surface your product to buyers who would never discover it through branded search alone. Over time, reviews and ratings create defensibility. Once a listing accumulates credibility, it becomes harder for newer competitors to displace it, even with aggressive marketing.

Listings also influence how buyers talk internally. A product that appears consistently across trusted directories is easier to justify during shortlisting, procurement, and stakeholder review.

Not all “site name” platforms serve the same purpose

One reason listings underperform is misalignment. Teams treat all directories as interchangeable when they are not.

Some platforms are built for evaluation, others for discovery, and others for ecosystem credibility. Understanding this distinction is what determines whether a listing drives value or just exists.

Instead of cataloging dozens of sites, it is more useful to focus on a small set that consistently shape buyer behavior.

The seven platforms that matter most, and why

Below are seven platforms that consistently show up in real buying journeys, each for a different reason. The value is not just being listed, but understanding what role each platform plays.

| Platform | What Buyers Use It For | Where It Fits Best |

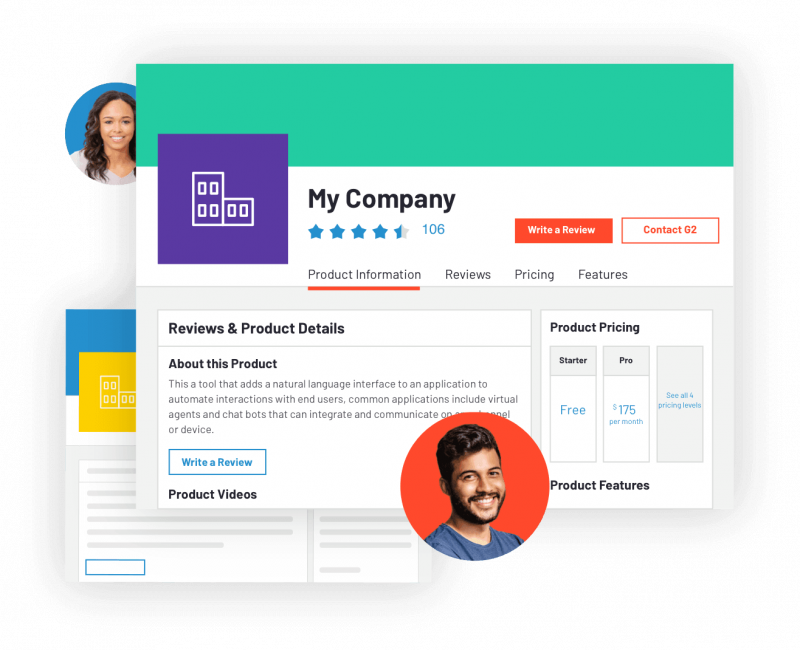

| G2 | Peer validation and comparison | Mid-funnel evaluation for B2B SaaS |

| Capterra | Broad software discovery | High-intent buyers across categories |

| GetApp | SMB-focused research | Tools targeting small and mid-market |

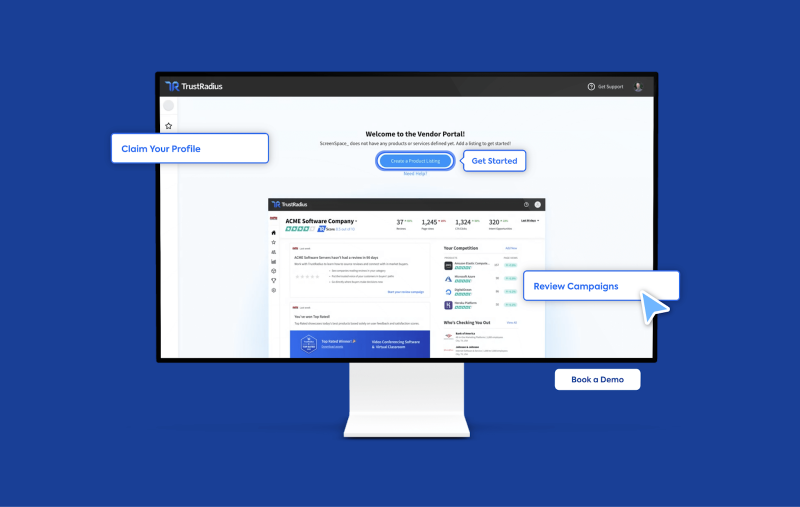

| TrustRadius | Deep, narrative reviews | Complex or enterprise software |

| SourceForge | Technical credibility | Developer and IT-led products |

| Product Hunt | Awareness and momentum | New launches or major updates |

| AlternativeTo | Replacement research | Tools competing with incumbents |

Rather than treating these as equal, it helps to see them as different entry points into the same decision process.

How each platform contributes to visibility

G2 and Capterra tend to influence shortlists. Buyers arrive with a category in mind and use reviews and comparisons to narrow options. Visibility here is about credibility and consistency rather than novelty.

GetApp operates similarly, but with a stronger SMB skew. Listings here often perform best when messaging is clear, pricing is understandable, and use cases are concrete.

TrustRadius serves buyers who want depth. Long-form reviews, trade-offs, and implementation stories matter more than star ratings. This makes it particularly effective for higher-consideration products.

SourceForge plays a different role. Its audience is more technical, and its domain authority gives listings long-tail SEO value. For developer-focused tools, it often acts as a quiet but steady discovery channel.

Product Hunt is temporal. It creates spikes rather than compounding flow. Its value lies in early visibility, feedback, and social proof, not sustained lead generation.

AlternativeTo captures a specific moment in buyer intent. When someone searches for “alternatives to X,” they are already dissatisfied. Visibility here places your product directly into a replacement narrative.

How directories decide whether you belong

Most major platforms apply explicit inclusion guidelines. Products must be live, packaged, and clearly fit an existing category. Listings that read like landing pages or rely on first-person promotion are often rejected or quietly downranked.

Some directories will create listings automatically using scraped data if vendors do not claim them. This alone is a reason to actively manage profiles. An unmanaged listing can misrepresent pricing, positioning, or even core functionality.

The unspoken rule is simple. Directories reward clarity and punish exaggeration.

Getting listed is procedural, not strategic

The mechanics of listing are straightforward. You create or claim a vendor profile, submit product details, upload assets, and pass basic verification.

What matters more is what happens after approval.

Listings that perform well are updated regularly. Screenshots reflect the current product. Descriptions evolve as positioning sharpens. Reviews accumulate gradually, not through one-off campaigns.

This is where many teams fall short. They complete the process, then move on.

Treating listings like high-intent landing pages

The biggest difference between a passive listing and an effective one is intent matching.

Buyers scanning directories want to know, quickly and plainly, whether a product fits their situation. That means outcome-focused summaries, concrete use cases, and honest boundaries.

Visuals matter more here than on your website. Screenshots are proof that the product exists as described. Videos that show workflows outperform brand narratives.

Pricing clarity also plays a role. Even ranges or models help buyers self-qualify, which improves lead quality downstream.

Reviews as signal, not theater

Reviews are the backbone of directory trust. Most platforms have verification mechanisms that make manipulation difficult, so the safest approach is also the most effective.

Request reviews after value is delivered. Encourage specificity. Respond publicly to criticism with context, not defensiveness.

Buyers read how vendors respond almost as closely as what reviewers say.

SEO impact that compounds quietly

Listings contribute to visibility in ways that are easy to underestimate. High-authority directories generate backlinks, brand mentions, and long-tail search visibility that supports your broader SEO profile.

Optimized listings can rank independently for category and comparison queries, effectively expanding your search footprint without additional content production.

This is why experienced teams treat directory strategy as part of SEO infrastructure, not a one-off submission task.

Free listings, paid placements, and restraint

Most major directories offer free profiles. Paid tiers add visibility, analytics, and lead routing, but they also introduce cost pressure.

A disciplined approach is to start free, observe where traction appears, then selectively test paid placements where buyer intent is already proven.

Visibility that cannot be measured eventually becomes noise.

The reality behind “where” visibility actually comes from

Boosting software visibility through listings is not about being everywhere. It is about being present in the places buyers already trust, at the moments when they are actively comparing options and looking for confirmation rather than persuasion. Visibility that shows up too early or in the wrong context rarely converts. Visibility that appears at the point of evaluation quietly carries weight.

Listings work because they impose discipline. They force clarity around positioning, audience, and use case. They expose vague claims and generic messaging, especially when placed next to competitors under the same criteria. In that sense, directories do not amplify marketing. They audit it.

This is also why listings reward accuracy, consistency, and patience. The benefits compound slowly through accumulated reviews, stable categorization, and sustained presence. Teams that update listings, respond to feedback, and align them with real product capabilities tend to see smoother sales conversations and fewer trust gaps later in the funnel.

Used well, listings shape outcomes without demanding attention. They reduce friction in shortlisting, strengthen internal buyer justification, and reinforce decisions that were already leaning in your favor. Used poorly, they do the opposite. Outdated profiles, exaggerated claims, or neglected reviews introduce doubt at exactly the wrong moment.

In the end, the difference is rarely about the platform itself. It is about whether the listing is treated as a strategic channel or a one-time task. Software visibility today is less about shouting louder and more about holding up under scrutiny. Listings simply make that scrutiny unavoidable.

Post Comment

Be the first to post comment!