By letting users easily launch tokens on Solana, Pump.fun has largely changed the memecoin market. In particular, its use of the bonding-curve model and also auto-listing on Raydium once the bonding curve completes has turned casual users into creators.

However, with increasing market demands, alternatives are being built and launched. The main focus of the newer platforms has been better analytics, automation, and multi-chain options.

Below, we explore the top Pump.fun alternatives you should check out, including their key features, user experience, and the blockchain(s) they support.

Quick Summary

- Pump.fun’s success has inspired a wave of new platforms focused on better analytics, smoother trading, and multi-chain support.

- Satsdaq brings discovery, analytics, and execution to the Bitcoin Layer 2 ecosystem through a secure, non-custodial token trading terminal.

- GMGN offers multi-chain token discovery and onchain intelligence tools for traders who want real-time signals and cross-chain opportunities.

- Moonshot and Raydium LaunchLab give Solana users faster token launches, bonding-curve mechanics, and access to Solana’s DEX liquidity.

- The right alternative depends on your preferred chain, trading style, and appetite for risk.

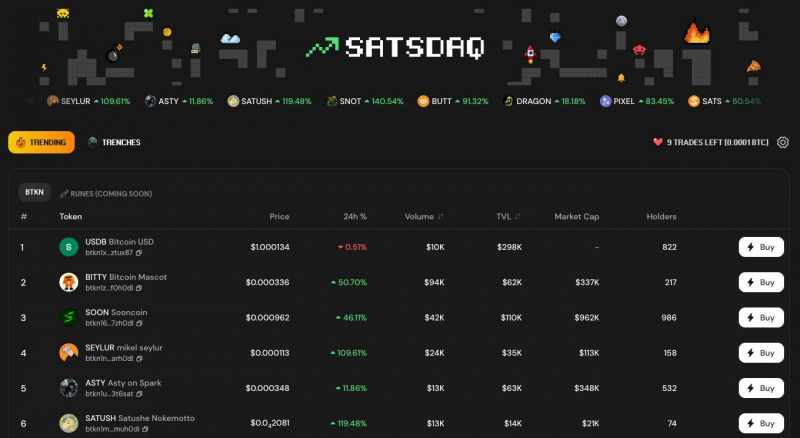

Satsdaq

Satsdaq is a trading terminal that is built to help you discover and trade assets in the Bitcoin L2 ecosystem. It allows you to securely execute the entire token trading process, starting with analysis and ending with a purchase and storage, all within a single interface inside the Xverse wallet.

Supported Blockchains

Satsdaq supports the Spark Bitcoin Layer-2 and its BTKN token ecosystem. The roadmap includes adding Stacks and Runes to the list of supported platforms. Because Satsdaq is integrated with the Xverse wallet, it inherits hardware-wallet support, multisig, and privacy-preserving zero-knowledge proofs.

Key Features

- Unified discovery and trading: Spot trending tokens, track new launches, and trade instantly from the same interface.

- Real-time analytics: Market cap, volume, bonding-curve progress, holder distribution, dev wallet activity, and more.

- Lifecycle tracking: Explore "Trending" tokens or monitor new releases through “Trenches” categories like New, About to Graduate, and Graduated.

- Xverse wallet integration: Trading executed directly inside your non-custodial Xverse wallet.

User Experience

Satsdaq streamlines discovery, analytics, and trading live on the same dashboard for Bitcoin L2 markets. You can jump from token discovery to execution without switching tabs. The Xverse Portal makes onboarding simple and secure on both desktop and mobile.

Security & Risks

Satsdaq is fully non-custodial. It doesn’t allow insecure wallet connections or QR-code shortcuts that increase exploit risks. However, like all emerging L2 ecosystems, a new token carries significant volatility and smart-contract risk. You should evaluate token fundamentals, bonding-curve behavior, and dev-wallet activity before buying.

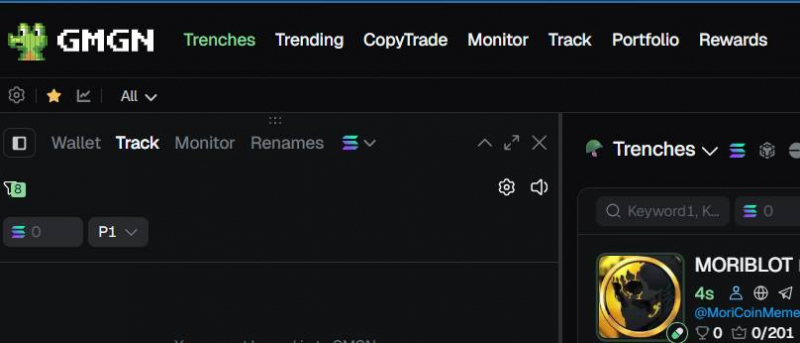

GMGN

GMGN is an onchain intelligence and trading platform built for the memecoin markets. It aggregates charts, wallet data, social signals, and token analytics into a single interface, making it easy for traders to spot new launches, track assets, and trade across multiple chains.

Supported Blockchains

GMGN supports several major EVM and non-EVM chains, including Ethereum, Solana, Base, and BNB Chain. The platform doesn’t act as a custodial service as the trades go through connected wallets like MetaMask, Phantom, or Rabby, depending on the chain.

Key Features

- Token discovery: View newly launched tokens, early-stage memecoins, and real-time trending assets on multiple chains.

- Smart-money tracking: Follow top wallets, copy their entries, and monitor their buys/sells as they happen.

- Advanced token analytics: Market cap, liquidity, holder changes, contract safety checks, buy/sell pressure, and onchain sentiment signals.

- Integrated trading: Route trades to decentralized exchanges such as Uniswap, Raydium, or PancakeSwap through your connected wallet.

User Experience

On GMGN, new tokens appear on the dashboard within seconds of launch, and most analytics are pulled directly from onchain activity. Its layout is closer to a social-style feed combined with a trading terminal. This allows you to jump from a new token to charts, contract analysis, and into a trade.

Security & Risks

GMGN is non-custodial, and transactions are executed via your connected wallet. Due to the high risk of rugs, liquidity pulls, and contract exploits, the platform offers contract security checks and basic anti-scam indicators, but only as guiding tools.

Moonshot

Moonshot is a popular Pump.fun alternative, especially for Solana users. The application facilitates the discovery, creation, and trading of meme tokens in a gamified environment with special focus on rewarding early adopters and social engagement.

Supported Blockchains

Moonshot is exclusively a Solana platform. It leverages the blockchain’s high-speed, low-fee infrastructure to make memecoin trading fast and frictionless. Since all token launches, trades, and bonding-curve transactions occur directly on Solana, there is seamless compatibility with the wider Solana DeFi ecosystem, including Raydium.

Key Features

● Token creation: Launch new tokens instantly using automated bonding curves.

● Leaderboard: Track the top-performing and trending memecoins in real time.

● DEX integrations: Trade seamlessly through major Solana DEXs like Raydium and Jupiter.

User Experience

Moonshot’s UI is more like a social app than a trading terminal. It makes it easy to spot hyped launches, while the one-tap buy/sell experience lowers barriers for casual traders. It’s generally faster and more interactive than Pump.fun, especially with a focus on virality.

Security & Risks

Like Pump.fun, anyone can launch a token on Moonshot. That means rug-pull risks are high. Also, many projects have no utility or roadmap beyond speculation. As a trader, you should verify contract safety and watch for bot-driven price spikes.

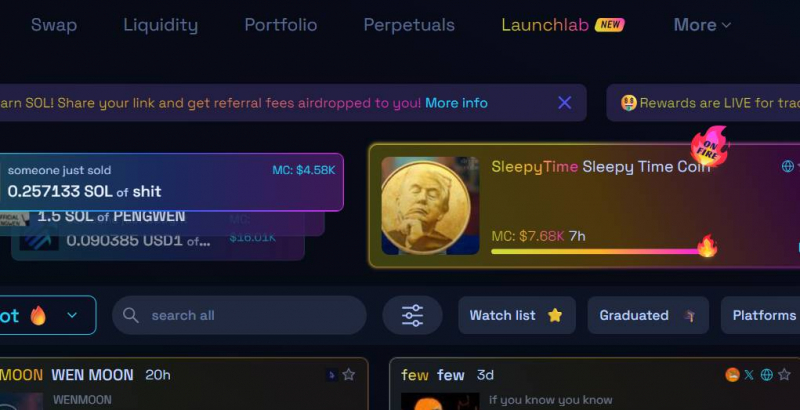

Launchpad (Raydium)

Raydium’s Launchpad, also known as LaunchLab, is one of the most popular token launch tools in the Solana ecosystem. While not focused exclusively on memes, it offers a more professional environment for new token launches.

Supported Blockchains

Raydium’s LaunchLab runs entirely on the Solana blockchain, tapping into the network’s mature DEX infrastructure and liquidity pools. Its deep integration with Solana’s on-chain trading environment allows for instant access to the broader Solana DeFi marketplace.

Key Features

● Raydium integration: Access deep liquidity and a seamless trading interface.

● Ecosystem partnerships: Leverage connections with Solana’s top DEX aggregators.

● Transparent dashboards: Track project performance and contributor activity in real time.

User Experience

LaunchLab’s interface is largely professional and data-driven. While it lacks the playful feel of Pump.fun or Moonshot, its structure appeals to serious creators and investors. The token launch process is guided, ensuring fewer scams and better transparency.

Security & Risks

Raydium’s LaunchLab is more secure than many other memecoin platforms. It has established smart contracts and audit history. However, it’s less speculative, and traders don’t find the same fast-moving meme action. The main risk is market performance rather than technical security.

Which Pump.fun Alternative Should You Use?

Choosing the best Pump.fun alternative comes down to how and where you prefer to trade.

Satsdaq is ideal for traders exploring Bitcoin Layer-2 assets and who want research, analytics, and execution in one place. GMGN suits multi-chain memecoin hunters who rely heavily on analytics and smart-money tracking.

Meanwhile, platforms like Moonshot and Raydium LaunchLab offer Solana users a fast, interactive environment for discovering new tokens and participating in early-stage launches.

No single platform is perfect for every trader. Your choice depends on whether you value analytics, user experience, chain preferences, or early-stage access. Explore each option and pick the one that best aligns with your memecoin trading strategy and risk tolerance.

Post Comment

Be the first to post comment!