As businesses increase their reliance on AI workflows and systems, developers are increasingly turning to muti-agent systems (MAS) and workflows for better reliability and scalability. A traditional AI workflow generally involves a single, monolithic “do-everything” agent that must handle the entire task, regardless of complexity. This approach works well enough for many use cases, but several limitations apply. The structure is more rigid, impacting maintenance and innovation. Changes or updates, for example, will take the entire agent offline.

Then there’s the problem of efficiency. A single agent will need a lot more memory per request as it needs to store and process more contextual data. This additional processing burden can also result in poor decision-making and generic output. On top of this, designing such an agent to be compliant with regulatory frameworks, ensuring data privacy, and more is more complex, making it harder to use such agents and workflows in sensitive industries such as fintech and healthcare.

Single- vs multi-agent AI workflows in action

Say you’re applying for a loan at a local bank. A single-agent system would need to handle everything from user interactions for application and data intake to document verification, risk assessment, regulatory and policy compliance, offer generation, and more. Sometimes, if the bank needs to update the application form, the agent may go offline. If there’s a policy update, a new law is passed, or a minor change is made to any process, the entire system can come to a halt while changes are being made.

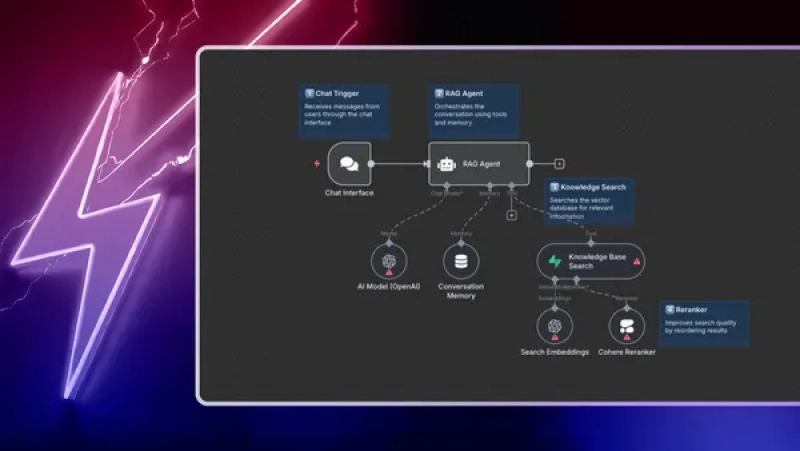

Multi-agent AI workflows address all of the above by splitting the work among multiple, specialised agents. In the above example, the bank could have a separate agent handle customer interactions, one for document verification, one for risk assessment, one for verifying compliance, and so on. This inherently allows for a more modular and fault-tolerant design, data compartmentalisation and thus better privacy, and more dynamic and scalable workflows.

MAS design

The structure of a multi-agent AI workflow draws from real life. MAS often follows a hierarchical design where you have a “manager” agent overseeing several specialised agents that report to it. Each agent has a clear and defined role, and they can talk to each other using standardised formats and protocols. As with real life, the “manager’s” job, essentially, is to monitor and orchestrate the functioning of these specialised agents.

Since the system is modular, agents can be added or removed as needed. Since the data and processing are compartmentalised, sensitive data is easier to secure, and resources are used more efficiently.

In the banking example above, a customer service agent can handle customer interactions, guiding them through forms and processes, while the data gathered is handed off to document verification and risk assessment agents that work in the background. This work can, in turn, be overseen by compliance agents, the output assessed separately by an agent that manages offer generation, and then the approved offer can be looped back to the customer service agent to present to the customer. If, for example, the customer only needs to open a bank account, the risk assessment and offer generation agents need not be involved.

An evolutionary step

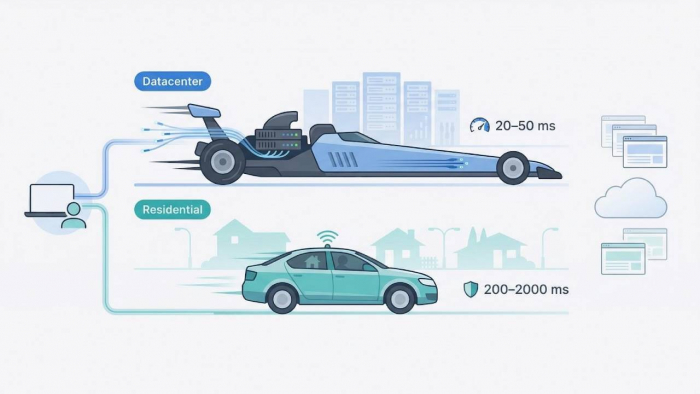

MAS and multi-agent workflows are a promising evolutionary step up from single-agent AI workflows and address fundamental issues that arise when scaling up single-agent platforms. They do, however, come with their own unique set of issues. These include increased architectural complexity, potentially higher operating costs, latency issues, and more.

While multi-agent workflows require more technical expertise and architectural planning, the potential benefits, especially in highly regulated industries such as banking, governance and healthcare, tend to justify the effort.

Post Comment

Be the first to post comment!