I’ll be honest — most accountants I know didn’t start their practice dreaming of juggling six different apps just to send one document to a client. Yet, here we are: logging into one tool for file storage, another for e-signatures, another for scheduling, and still somehow chasing down missing information in email threads.

This is where TaxDome often enters the conversation. Not as another tool to add to the pile, but as a platform that says, “Let’s clear the clutter.” The big question is: does it actually deliver on that promise — and is it the right fit for your practice? Let’s walk through what I’ve seen work well, where it might not click for everyone, and the types of firms that tend to get the most out of it.

The heart of TaxDome: more than “just software”

On paper, TaxDome is an all-in-one, cloud-based practice management solution. In practice, it’s a way to take the sticky notes off your monitor and put everything — client communication, workflows, billing, document sharing — in one place.

What I like is that it’s not purely a “tech company” approach. Yes, there’s automation, AI-powered insights, and slick dashboards. But there’s also a strong community element — webinars, forums, and feedback loops where your input can actually shape future updates. It’s the rare case where the developers seem just as invested in the accounting profession as the accountants themselves.

Why firms tend to rave about it

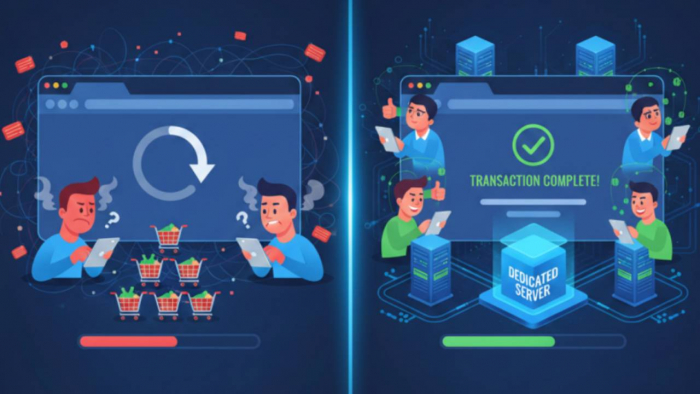

If I had to sum it up, the appeal is this: fewer moving parts, more momentum. Firms tired of paying for a patchwork of software find real relief when they consolidate. That means fewer logins to remember, less manual data entry, and fewer frantic moments searching through email threads when a client calls.

Here’s a striking sign of the times: the global practice management software market is projected to grow from about $0.8 billion in 2024 to $0.9 billion in 2025, reflecting a brisk 12.2% year-over-year growth rate — a clear signal that firms of all sizes are investing in streamlined, unified systems. And when you zoom out, the global practice management software market is expected to reach $2.36 billion by 2031, growing at a steady 7.8% CAGR, further affirming the shift toward integrated platforms.

Clients benefit just as much. Secure portals, e-signatures, and the ability to sign documents from their phones make every interaction smoother. I’ve seen firms win new business simply because their client experience feels more polished than the competition’s.

Scalability is another selling point. A solo preparer can get through tax season without burning out, then grow the business without overhauling the tech stack. And because TaxDome updates regularly—often based on direct user feedback—the platform feels like it’s evolving alongside your practice instead of leaving you behind.

Where it can fall short

Of course, any platform this comprehensive comes with a learning curve. Jump in without a plan and it’s a bit like stepping into a warehouse of tools without knowing which one to grab first. The sheer number of features can overwhelm, especially if you’re coming from a few basic systems you’ve used for years.

There’s also the human side of implementation to consider. I’ve seen firms buy a platform like TaxDome with high hopes, only for adoption to stall because no one was tasked with championing the change. Getting value out of it isn’t just about signing up; it’s about configuring workflows, training your team, and committing to new processes.

And while its breadth is a strength, some niche tools still offer deeper functionality in highly specialized areas. If your style is “turn it on and use it as-is,” all those customization options might feel like too much at first.

The firms that tend to thrive on TaxDome

In my experience, solo practitioners and small firms often get the biggest lift. For them, TaxDome becomes almost like a virtual assistant — automating repetitive tasks, keeping client communication in one place, and reducing the need for extra staff.

Small-to-mid-sized firms, especially those eyeing growth, use it to scale their operations without losing the personal service that sets them apart. The ability to onboard clients quickly, handle more projects at once, and keep everything running through a single portal makes it easier to compete with bigger players.

Larger firms see different benefits. Multi-location support, AI-powered analytics, and integrations with existing tools help them keep complex operations streamlined. Across all sizes, the common thread is an openness to change — the teams that lean in and make the platform their own see results faster than those who try to use it as a drop-in replacement for their old setup.

How to decide if it’s right for you

When I’m weighing whether a tool like this is a good match, I start by looking at pain points. If inefficiency, scattered communication, or tool sprawl are slowing you down, TaxDome directly addresses all three. Then I think about growth — not just whether the software can handle more clients, but whether it can help you get there without adding chaos.

The human side matters, too. Is your team willing to learn something new and adapt their workflows? If not, even the best features will gather dust. And finally, I’d do an honest cost comparison. The subscription fee is one thing, but so is the silent cost of wasted time, missed follow-ups, and managing multiple disconnected systems.

Final thoughts

TaxDome isn’t a magic wand, but it can be a powerful partner if you’re ready to rethink how your practice runs. It brings order to chaos, offers a better client experience, and frees you to focus on the parts of the job that made you start your practice in the first place.

Software should feel like it’s helping you grow, not holding you back. If your current setup has you juggling tabs, chasing emails, and wondering whether something slipped through the cracks, it might be time to see if TaxDome can give you more than just a cleaner desk — maybe even a clearer head.

Post Comment

Be the first to post comment!