Table of Content

The holiday shopping season can make or break a retailer's year. Black Friday, Cyber Monday, and the weeks leading up to the New Year generate massive transaction volumes that test every system. When payment processing fails during these critical periods, the consequences extend far beyond lost sales—frustrated customers, damaged reputation, and missed opportunities pile up quickly.

Many businesses focus on inventory, staffing, and marketing while treating payment systems as an afterthought. The failure to streamline payment processing before peak demand arrives creates cascading problems that impact every aspect of operations.

Getting Your Systems Ready for the Storm

Test Everything Before the Rush Hits

Waiting until Black Friday to discover system weaknesses is a recipe for disaster. Payment infrastructure needs stress testing well in advance to identify bottlenecks and failure points.

Running simulated peak traffic reveals problems hiding beneath the surface. This means testing more than just whether the website stays online—payment authorization speeds, database performance, and third-party connections all need scrutiny under realistic load conditions.

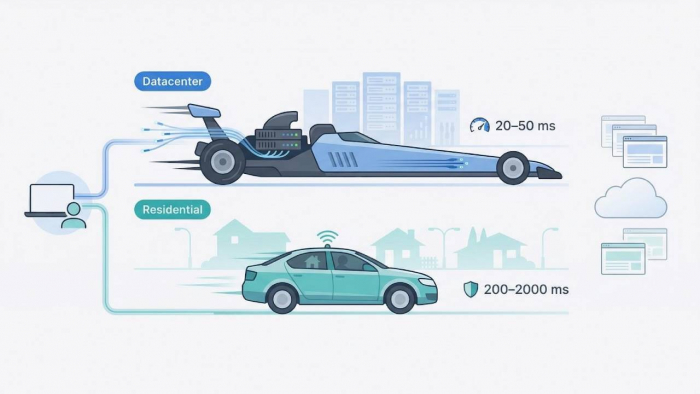

The businesses that streamline payment processing successfully don't rely on a single provider. When one payment gateway experiences technical difficulties, smart routing automatically redirects transactions to backup systems without customers noticing anything wrong.

Speed Up Your Checkout Process

Long, complicated checkout procedures kill sales faster than anything else. Each unnecessary step gives customers another chance to abandon their carts and shop elsewhere.

Here's what actually works to streamline payment processing at checkout:

- Remove forced account creation—let customers check out as guests

- Enable autofill for payment forms to reduce typing

- Offer one-click purchasing for returning customers

- Keep forms short with only essential information

- Make sure payment buttons are large and obvious on mobile screens

Mobile shopping now dominates online retail, which means payment interfaces must work perfectly on smaller screens. Clunky mobile checkout experiences drive customers straight to competitors who've optimized for smartphones.

Offering Payment Options That Customers Actually Want

Beyond Traditional Cards

Digital wallets have become the preferred payment method for many shoppers. Apple Pay, Google Pay, and similar services offer speed and convenience that traditional card entry can't match. These transactions process faster, which means shorter lines and happier customers.

Smart retailers also consider international shoppers during peak seasons. Supporting regional payment methods and offering dynamic currency conversion opens doors to cross-border sales that might otherwise never happen. The approach to streamline payment processing must account for diverse customer preferences across different markets.

Buy-now-pay-later options address another customer need during expensive holiday shopping periods. These services let shoppers spread larger purchases across several months while shifting credit risk away from the retailer.

Making In-Store Payments Move Faster

Physical retail faces unique challenges during busy shopping periods. Queue length directly impacts sales—customers have limited patience for long waits, especially during hectic holiday shopping.

Portable payment terminals transform any staff member into a mobile checkout point. This flexibility proves invaluable during unexpected rushes or when certain store areas experience higher traffic than others. Retailers who streamline payment processing in physical locations often see immediate improvements in customer satisfaction.

Contactless payments shave precious seconds off each transaction. Those seconds multiply across thousands of daily sales, creating meaningful capacity increases without adding checkout stations or hiring more staff.

Handling the Cross-Channel Puzzle

Modern shoppers don't follow straight lines anymore. They research products on phones, compare prices on laptops, and might complete purchases through entirely different channels. This fragmentation creates real challenges for payment systems.

Buy-online-pickup-in-store services gained massive popularity and show no signs of disappearing. Customers save shipping costs, get products immediately, and can inspect items before taking them home. The catch? Payment systems must handle these mixed transactions smoothly.

Returns work the same way in reverse. Products bought online often get returned in physical stores, requiring payment platforms that process refunds accurately regardless of where the original purchase happened. Organizations that successfully streamline payment processing make these cross-channel transactions feel seamless.

Keeping Fraud in Check Without Slowing Things Down

Peak shopping periods attract fraudsters looking to exploit increased transaction volumes and distracted staff. The challenge lies in catching bad actors without blocking legitimate customers or disrupting the flow of streamlined payment processing systems.

Effective fraud prevention during busy periods requires:

- Real-time transaction monitoring that flags suspicious patterns

- Multi-layered authentication that feels seamless for real customers

- Smart systems that learn normal purchasing behaviors

- Clear protocols for handling flagged transactions quickly

Digital wallets help with security compliance while actually improving the customer experience. They handle authentication requirements in ways that feel invisible to shoppers, which explains why retailers actively promote their adoption.

Preparing for What Comes After

Peak season doesn't end when the last sale processes. The following weeks bring elevated return volumes, customer service demands, and complex financial reconciliation work.

Gift cards create their own tracking challenges. These popular holiday items represent financial liabilities until redeemed, requiring robust systems to monitor outstanding balances and forecast redemption patterns.

Organizations that successfully streamline payment processing treat February as prime time for planning. Transaction data from the recently completed season remains fresh, staff can provide detailed feedback, and sufficient time exists to implement meaningful changes before the next cycle begins.

The Technology Foundation That Makes It All Work

Payment orchestration platforms have emerged as powerful tools for managing complex payment scenarios. These systems route transactions intelligently based on cost, performance, and reliability—particularly valuable when handling high volumes.

Cloud-based infrastructure provides scalability that on-premise systems simply cannot match. The ability to automatically scale computing resources during traffic spikes, then scale back during quieter periods, optimizes both performance and costs.

Interestingly, the healthcare industry offers valuable lessons here. The concept of streamlined healthcare payment processing demonstrates how complex billing scenarios involving multiple payers can be managed efficiently. Healthcare providers have developed sophisticated systems for routing payments that retailers can adapt for managing marketplace transactions and vendor payouts.

Getting Your Team Ready

Technology means nothing without people who understand how to use it effectively. Staff training often gets rushed or skipped as businesses scramble to implement new systems before peak season arrives.

Operational procedures for handling payment exceptions, technical failures, and customer disputes need documentation and practice before problems arise. When systems hiccup during peak periods, staff should know exactly who to contact, what information to collect, and how to keep transactions moving.

Final Thoughts

The ability to streamline payment processing during peak sales events separates thriving businesses from those barely surviving their busiest periods. Success requires treating payment systems as strategic infrastructure rather than operational afterthoughts.

From stress testing and backup systems to staff training and mobile optimization, each element contributes to a payment experience that supports revenue goals instead of undermining them. The businesses that master these fundamentals will find themselves with advantages extending well beyond any single shopping season.

Post Comment

Be the first to post comment!