Table of Content

- The Rise of Pocket Option in the Shadows

- A Culture of Quick Wins — and Quicker Losses

- Pocket Option Trading App: Is It Safe to Download?

- Pocket Option Minimum Deposit & Withdrawal Rules

- Does Pocket Option Work in India, UK, or the EU?

- Pocket Option Demo Account: Learning Without Losing?

- The Hidden Machinery — How Pocket Option Really Operates

- Pocket Option Real or Fake? What Independent Sources Say

- User Struggles You Don’t See in Ads

- When Regulators Step In (and When They Don’t)

- The Emotional Cost of Trading Here

- Who Really Profits?

- Pocket Option vs Regulated Brokers: Which Protects You Better?

- How Pocket Option Markets “Easy Money” to New Traders

- Top Pocket Option Complaints (Based on Reviews)

- Alternatives That Don’t Burn Bridges

- Verdict — Pocket Option’s Place

If you’ve ever looked into online trading, you’ve probably seen ads for Pocket Option. Flashy banners promise easy profits, low deposits, and a slick mobile app. But what’s the real story behind this offshore broker? Let’s go deeper than the hype and unpack the realities of Pocket Option.

The Rise of Pocket Option in the Shadows

Pocket Option entered the market in 2017, right when crypto and binary options were gaining global attention. Platforms like this thrive in moments of hype — where new traders want in quickly and regulators haven’t fully caught up.

Operating from offshore jurisdictions like Costa Rica and the Comoros Union, Pocket Option positioned itself as an “accessible” trading gateway for beginners. That accessibility, however, comes with strings attached.

And that brings us to the culture Pocket Option feeds: the promise of quick wins, but often quicker losses.

A Culture of Quick Wins — and Quicker Losses

Binary options are attractive because they look simple: predict whether a price will go up or down in a set time, and you could double your money in minutes. Pocket Option’s marketing leans heavily on this psychology, advertising payouts up to 92% for correct trades.

But the flip side is brutal: one wrong prediction and you lose everything staked. This “all-or-nothing” setup creates a gambling-like cycle. The instant dopamine rush keeps traders hooked, even when the odds aren’t in their favor.

Which is why many people turn to the Pocket Option app — a tool designed to keep the cycle going.

Pocket Option Trading App: Is It Safe to Download?

The Pocket Option app on Google Play has been downloaded thousands of times and offers access to the platform anywhere. On the surface, it looks polished: demo accounts, trading charts, and quick deposits via card or crypto.

But the question isn’t just about functionality — it’s about safety. The app itself may run smoothly, but since it connects to an offshore broker with minimal oversight, users face risks beyond their screen: data privacy, fund safety, and lack of legal recourse.

And this is where deposits and withdrawals come into play — the part most traders care about the most.

Pocket Option Minimum Deposit & Withdrawal Rules

According to the official site, you can get started with as little as $5, and deposits are instant via card, e-wallet, or crypto. Withdrawals, on paper, are “commission-free.”

But many user reviews tell another story. On Trustpilot, traders report weeks of waiting for payouts, repeated identity verification requests, and sometimes total account freezes. While deposits are easy, withdrawals often become a frustrating obstacle course.

Which leads to the next logical question: where exactly does Pocket Option operate, and is it even legal where you live?

Does Pocket Option Work in India, UK, or the EU?

India: Binary options are not regulated by SEBI, meaning platforms like Pocket Option operate without authorization. Depositing funds here can fall into legal gray areas under FEMA rules.

UK/EU: The FCA banned binary options for retail in 2019, while ESMA confirmed the ban across Europe. Pocket Option is not licensed in these regions.

Comoros: The license comes from the Mwali International Services Authority, which doesn’t carry the same protections as top-tier regulators.

If legality is murky, some traders try Pocket Option’s demo first to test the waters. But even that has limits.

Pocket Option Demo Account: Learning Without Losing?

One of the most appealing features of Pocket Option is its free demo account. You get virtual money to test trades without risking a cent. For absolute beginners, this is a great way to practice.

However, trading psychology shifts dramatically when real money is on the line. A demo win feels nice, but it doesn’t carry the stress of risking your own funds. Many traders report overconfidence after demo success, only to be humbled once they switch to live trades.

And behind all these features lies the real machinery — the offshore setup that powers Pocket Option.

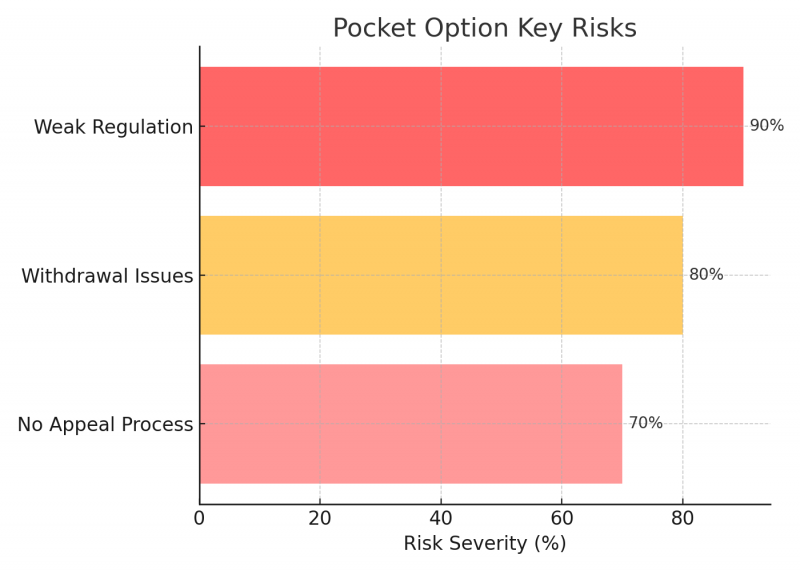

The Hidden Machinery — How Pocket Option Really Operates

Pocket Option is registered in Costa Rica and licensed through Comoros, which places it under “Tier-3” regulation. That means:

- No investor compensation scheme.

- No independent audits of trade data.

- No obligation to segregate client funds.

According to the Traders Union, this makes Pocket Option fundamentally riskier than brokers under regulators like FCA or ASIC.

And it’s this lack of oversight that fuels the big debate: is Pocket Option real or fake?

Pocket Option Real or Fake? What Independent Sources Say

Pocket Option is undeniably real — it’s been operating since 2017, has a functioning app, and processes trades. But “real” isn’t the same as “trustworthy.”

Independent reviewers like BrokerChooser caution against using it, precisely because it lacks top-tier regulation. On Reddit forums, users frequently label it as risky, if not outright manipulative.

And those warnings are backed up by consistent user struggles.

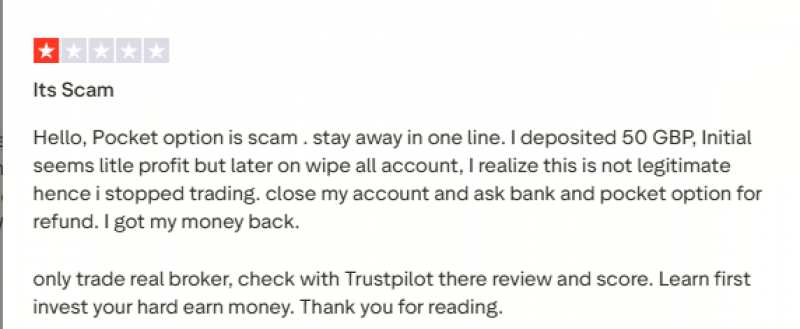

User Struggles You Don’t See in Ads

Scroll through Trustpilot reviews, and you’ll see repeated themes: blocked withdrawals, unresponsive support, and accounts closed without explanation. Google’s own support forums carry similar complaints.

While a handful of users report successful trades, the overwhelming sentiment is frustration and mistrust.

Regulators have noticed these patterns too — and some have already taken action.

When Regulators Step In (and When They Don’t)

- The FCA in the UK has blacklisted similar binary brokers for offering services without authorization.

- The ESMA ban applies across Europe, keeping retail traders out of binary options altogether.

- In India, SEBI has repeatedly warned against offshore brokers.

Despite this, Pocket Option continues to operate globally, relying on jurisdictions where enforcement is weak.

But the cost isn’t just financial — it’s emotional too.

The Emotional Cost of Trading Here

Trading on a platform like Pocket Option isn’t just about numbers on a screen. The fast pace and high stakes create stress, compulsive behavior, and gambling-like cycles. Many traders describe checking the app constantly, chasing losses, and feeling anxiety after repeated failures.

And in that environment, one has to ask: who really profits here?

Who Really Profits?

Binary options are structured so that when you lose, the broker gains. Without regulatory oversight, payout percentages and trade outcomes are entirely in-house. Unlike regulated brokers, there’s no requirement to prove price fairness.

In short: the house almost always wins.

So, let’s put that in perspective by comparing Pocket Option to a regulated broker.

Pocket Option vs Regulated Brokers: Which Protects You Better?

| Feature | Pocket Option | FCA/ASIC Broker |

| Regulation | Offshore (Comoros) | Tier-1 |

| Withdrawals | Frequent delays reported | Standard timelines |

| Compensation Scheme | None | Yes (FSCS/ASIC coverage) |

| Price Transparency | Internal feed | Audited feeds |

And while Pocket Option keeps marketing itself as “easy money,” that marketing deserves a closer look.

How Pocket Option Markets “Easy Money” to New Traders

Browse Pocket Option’s quick-start guide and you’ll notice language like “simple,” “fast,” and “profitable.” These hooks are designed to appeal to beginners who want results quickly. The promise of low deposits and demo account wins sets the bait — but switching to real money is where most losses happen.

And those losses are reflected in the top complaints users raise year after year.

Top Pocket Option Complaints (Based on Reviews)

- Withdrawals delayed or denied.

- Customer support ignoring tickets.

- Accounts frozen after big wins.

- Payout percentages adjusted without notice.

These complaints dominate Trustpilot and other forums, painting a consistent picture across geographies.

Which is why it’s important to consider alternatives before committing.

Alternatives That Don’t Burn Bridges

Safer routes include:

- Trading CFDs or ETFs with regulated brokers.

- Using demo-only apps for practice.

- Learning from structured courses on Udemy.

Which leads us to the verdict: where does Pocket Option stand in 2025?

Verdict — Pocket Option’s Place

Pocket Option is real, but risky. It’s easy to sign up, offers a flashy app, and has low entry requirements. But between weak regulation, endless withdrawal complaints, and manipulative marketing, it’s not a safe choice for the average trader.

In short: Pocket Option thrives where regulation is weakest and curiosity is strongest. If you’re serious about trading, it’s better to protect your money with a regulated broker — not gamble it away offshore.

Post Comment

Be the first to post comment!