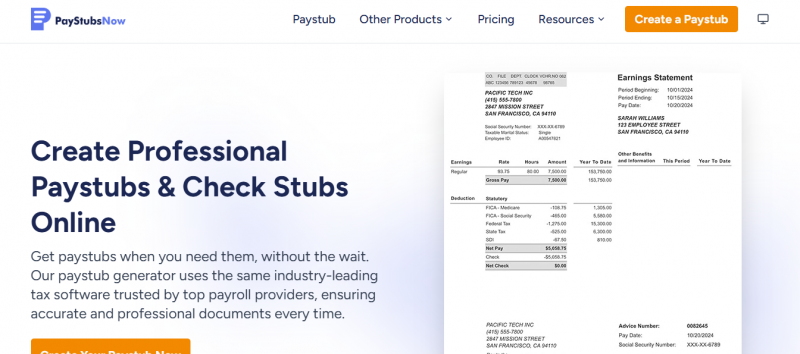

Payroll is an integral part of the most modern workplaces. One tool that has received a lot of attention is the paystub maker. It is equipped with tools that allow you to generate paystubs accurately and compliantly. Awareness of the features of a paystub maker can play a crucial role in increasing the efficiency of businesses.

User-Friendly Interface

A paystub maker needs to be simplified as a core feature. A simple web layout will help employees and employers navigate the system without an issue. It is user-friendly and accessible to everyone, as there is a slight learning curve with clear instructions and an intuitive design. The convenience of use reduces the risk of errors and saves time.

Customization Options

Another critical aspect is flexibility. Every business is different, and a good paystub tool features some level of customization and the ability to customize the templates per the company's needs. Customization adds professionalism and consistency, whether adding a logo or opting for a certain format.

Security Measures

Security is of paramount importance when it comes to sensitive information. The paystub maker will not be trustworthy without secure data to back it up. Personal and financial information is protected with features like encryption and secure login protocols. Such protection fosters trust and guarantees adherence to privacy regulations.

Automatic Calculations

Human calculations can be error-prone. A good paystub generator performs these calculations automatically to avoid deductions, taxes, and net pay errors. It helps both prevent errors and accelerate payroll. It saves time required for many important and work-related tasks, ultimately increasing productivity.

Compliance with Regulations

Legal compliance is a must, literally. State and federal compliance: Paystub makers must comply with state and federal regulations. Executable tax and employment standards updates are worth their weight in gold. This ensures compliance with all legal requirements for pay stubs, minimizing the risk of penalties.

Multi-Device Accessibility

In a mobile-first world, it needs to be accessible from multiple devices. Paystub makers should work on desktops, tablets, and smartphones. This flexibility allows users to access any information whenever it is needed at any time, from anywhere. The multi-device compatibility helps you work from home and gives you easy access.

Integration Capabilities

The paystub maker must integrate with other software, such as Accounting or Human Resource Management Systems, to be effective. With integration, you do not have to enter any data manually; data flows seamlessly between the systems. This connectivity improves the workflow and avoids redundancy.

Support and Resources

Another key benefit is access to help and educational resources. A good paystub maker has customer service to help with any problems. Furthermore, tutorials and guides provide additional insight into the system. Emergency assistance allows consumers to take full advantage of all the available research needs.

Cost-Effectiveness

Budget considerations are always important. A proper paystub maker must keep the prices in check, but it should also provide value that is worth your money. Transmission pricing models allow businesses to take their pick, whether subscription-based or otherwise. Cost-effectiveness so that even smaller companies can benefit from effective payroll management.

Reporting and Analytics

Data-driven decisions require insights. Paystub makers with reporting and analytics capabilities provide businesses with very useful information. You can create reports about payroll trends, employee income, etc. These insights help you plan strategically and make smarter decisions.

Eco-Friendly Solutions

Due to increasing environmental issues, sustainable practices are becoming the most significant requirement. Using digital pay stub makers also minimizes the amount of paper needed, thereby allowing the environment to breathe better. By reducing paper usage, businesses can gain an upper hand in green initiatives and encourage sustainability.

Conclusion

Several features of having a paystub maker can help you decide on your best choice. All of them are critical for user-friendliness, security, and compliance. Features such as flexibility, automation, and integration are even more features. Ease of access, availability, affordability, and environmental sustainability round out the package. Focusing on these aspects will help in ironing out payroll processes to be accurate and efficient.

Post Comment

Be the first to post comment!