In a significant move that signals the intensifying competition within the enterprise artificial intelligence sector, Anthropic has officially added Allianz, one of the world’s largest insurance and asset management providers, to its growing roster of corporate clients. This partnership represents a major milestone for the San Francisco-based AI startup as it continues to challenge industry incumbents like OpenAI and Google for dominance in the high-stakes world of corporate digital transformation. By integrating Anthropic’s advanced Claude models into its global operations, Allianz joins a prestigious list of organizations seeking to leverage generative AI to streamline complex workflows, enhance customer service efficiency, and bolster data-driven decision-making within the highly regulated financial services industry.

The collaboration is built upon the deployment of Anthropic’s Claude 3.5 model family, which has recently garnered acclaim for its superior performance in coding, nuanced reasoning, and linguistic accuracy. For a multinational entity like Allianz, which operates across diverse markets and regulatory environments, the primary appeal of Anthropic lies in its "AI safety" first approach. Financial institutions are increasingly prioritizing models that offer high reliability and lower risks of "hallucination," a critical factor when dealing with sensitive insurance claims, policy underwriting, and risk assessment. The integration is expected to empower thousands of Allianz employees, providing them with sophisticated tools to automate administrative tasks and synthesize vast amounts of internal data, thereby allowing human agents to focus on more complex, high-value client interactions.

This enterprise win comes at a pivotal moment for Anthropic, as the company aggressively expands its commercial footprint. While OpenAI has long held a lead in market awareness, Anthropic is successfully carving out a niche among Fortune 500 companies that demand enterprise-grade security and ethical transparency. The deal with Allianz is particularly strategic given the insurance giant’s massive scale, serving over 125 million customers in more than 70 countries. Industry analysts suggest that this partnership serves as a powerful "proof of concept" for other conservative industries, demonstrating that generative AI is moving beyond the experimental phase and into the core of global corporate infrastructure.

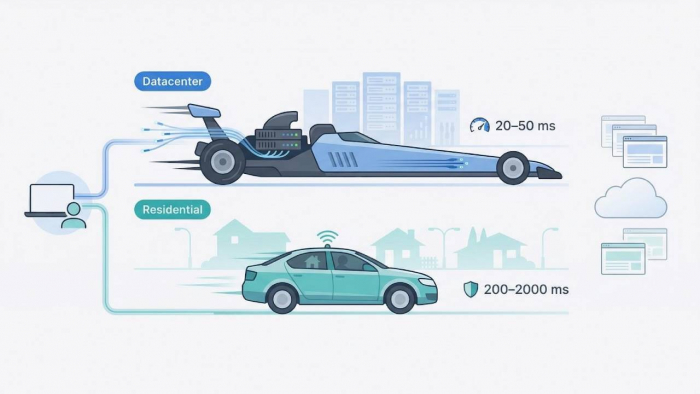

Furthermore, the partnership highlights the symbiotic relationship between AI developers and cloud providers. Allianz is leveraging Anthropic’s technology through Amazon Bedrock, a fully managed service from Amazon Web Services (AWS) that allows businesses to build and scale generative AI applications. This infrastructure allows Allianz to maintain rigorous data privacy standards, ensuring that proprietary information remains within their secure cloud environment while still benefiting from the cutting-edge capabilities of the Claude models. As the insurance sector faces increasing pressure to modernize, the adoption of Anthropic’s technology is viewed as a defensive and offensive maneuver both reducing operational costs and setting a new standard for technological agility in the 21st century.

Post Comment

Be the first to post comment!