People who bet regularly on sports or casino games often need organized systems for tracking their activity. Keeping detailed records helps understand spending patterns over time. Games like Chicken Road and various betting platforms generate multiple transactions worth documenting. Personal financial organization varies based on betting frequency and amounts wagered.

Different bettors use different tracking approaches. Some prefer digital spreadsheets while others use mobile apps designed specifically for betting activity. Paper logs work for those who prefer physical records. The method matters less than consistency in recording transactions.

Building Personal Record-Keeping Systems

Tracking betting activity manually takes time but creates clear financial pictures. Regular documentation prevents confusion about actual spending versus perceived amounts.

Spreadsheets work well for people comfortable with basic programs. Column headers typically include date, platform, bet type, stake amount, result, and net outcome. Daily updates take five minutes but build valuable records over time. Yearly totals emerge automatically with simple formulas.

Mobile apps designed for bettors automate much of this tracking work. These programs connect directly to betting accounts. They pull transaction history and categorize activity automatically. Monthly reports are generated with a few taps. Some integrate with budgeting software for broader financial planning.

Paper logs serve those preferring physical documentation. A dedicated notebook with standardized entries works perfectly. Attaching betting slips or printouts provides backup records. Fireproof storage boxes protect these documents from accidental damage. Many bettors keep several years of records for reference.

Elements betting records commonly include:

- Date and time of each wager placed.

- Name of betting platform or location.

- Specific event or game wagered on.

- Amount wagered on each bet.

- Odds received at placement time.

- Final outcome with win or loss amount.

- Running balance after each transaction.

- Payment method used for deposits and withdrawals.

Banking statements alone don't show detailed betting activity. A $500 deposit to a betting account doesn't reveal how those funds performed. Ten bets of $50 each produce different results than one $500 bet. Detailed records provide clarity that bank statements can't match.

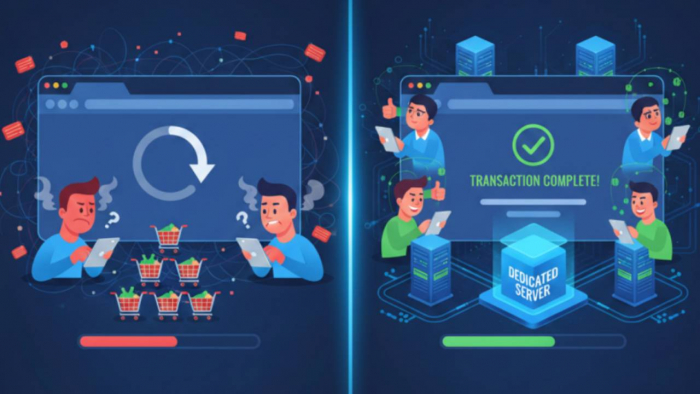

Banking Strategies for Betting Funds

Separating betting money from regular finances clarifies actual performance patterns. One checking account holding everything makes tracking nearly impossible. Bills mix with betting deposits, creating confusion about spending. Dedicated accounts create clear boundaries between betting and living expenses.

Online banks offer free checking accounts suitable for this purpose. Transferring a set amount monthly to a designated gambling account establishes boundaries. Winnings stay in that account or move to savings separately. This prevents betting activity from affecting rent or grocery budgets.

Some regular bettors maintain three separate accounts for betting activities:

- Account one receives initial deposits and handles active betting.

- Account two holds profits set aside from winning periods.

- Account three acts as a reserve for bankroll management.

Payment method considerations for betting:

- Debit cards linked to dedicated betting accounts.

- E-wallets like PayPal or Skrill for online platforms.

- Prepaid cards loaded with specific amounts.

- Direct bank transfers for larger deposits.

- Cryptocurrency options on some platforms.

Digital Tools for Financial Tracking

Technology simplifies betting activity documentation through specialized software. These programs vary in features and complexity levels.

Spreadsheet Templates

Pre-built spreadsheet templates designed for betting tracking save setup time. Many free templates exist online for download. They include formulas for calculating totals and win rates automatically. Users input basic information and calculations happen automatically.

Google Sheets allows access from multiple devices with automatic cloud saving. Excel provides more advanced features for detailed analysis. Both work well depending on personal preferences and technical comfort levels.

Dedicated Betting Apps

Mobile applications built specifically for betting tracking offer convenience. They sync across devices for record access anywhere. Many include features like:

- Automatic odds tracking at bet placement time.

- Win/loss charts showing patterns over time.

- Bankroll management calculators.

- Export functions for sharing data with financial software.

- Backup systems prevent data loss.

Each offers different features at various price points. Free versions typically include basic tracking while paid subscriptions add advanced analytics.

Banking Apps with Categories

Regular banking apps allow transaction categorization. Creating a "betting" category tags all related transactions automatically. Monthly spending reports show betting activity alongside other expenses. This provides context for how betting fits into overall finances.

Such apps excel at categorization. They connect to bank accounts and credit cards automatically. Users simply tag transactions appropriately during initial setup.

Money Management Frameworks for Bettors

Organized approaches to betting finances help maintain spending boundaries. Different systems work for different people based on income and betting frequency.

Fixed Budget Method

This approach allocates a specific amount monthly for betting activities. Once that amount depletes, no additional betting occurs until the next month. The budget amount stays consistent regardless of wins or losses during the period.

Setting the budget may involve:

- Calculating discretionary income after bills and savings.

- Allocating 5-10% of discretionary funds to betting.

- Creating automatic transfers on payday to betting accounts.

- Treating the budget as entertainment spending like dining out.

Unit System

The unit system divides bankrolls into standard bet sizes. A $1,000 bankroll might use $50 units (20 units total). Most bets use one unit regardless of confidence level. This prevents disproportionately large bets that could deplete funds quickly.

Unit system benefits:

- Standardizes bet sizing across all wagers.

- Prevents oversizing on "sure things".

- Makes tracking win rates easier across different bet types.

- Allows bankroll to grow or shrink proportionally.

Some bettors wager fixed percentages of current bankroll on each bet. Common percentages range from 1-5% per wager. As the bankroll grows, bet sizes increase proportionally. When the bankroll decreases, bet sizes shrink automatically.

This method requires calculating current bankroll before each bet. It provides built-in adjustment to changing financial situations.

Tracking Performance Metrics

Beyond simple win/loss records, additional metrics reveal betting patterns and performance trends.

Return on Investment (ROI)

ROI shows overall profitability as a percentage. Calculate by dividing net profit by total amount wagered. A bettor wagering $10,000 total with $500 net profit shows 5% ROI. This metric allows comparison across different time periods.

Win Rate

Win rate expresses successful bets as a percentage of total bets placed. Winning 55 of 100 bets equals a 55% win rate. This metric varies significantly between bet types. Favorites typically require higher win rates than underdogs for profitability.

Average Bet Size

Tracking average bet size reveals whether betting amounts stay consistent. Large variations might indicate emotional betting patterns. Consistent average sizes suggest disciplined approaches to bankroll management.

Longest Winning/Losing Streaks

Recording streaks shows variance patterns in betting activity. Understanding normal variance prevents overreaction to temporary swings. Most bettors experience streaks longer than they expect based on overall win rates.

These metrics work together creating comprehensive performance pictures:

| Metric | Calculation | What It Shows |

| ROI | (Net Profit / Total Wagered) × 100 | Overall profitability percentage |

| Win Rate | (Wins / Total Bets) × 100 | Percentage of successful wagers |

| Average Bet | Total Wagered / Number of Bets | Typical stake size |

| Streak Length | Consecutive wins or losses | Variance patterns |

Clear boundaries between betting funds and living expenses prevent financial stress. Mixing these pools creates confusion about actual betting performance and available funds for bills.

Creating separation involves:

- Opening dedicated accounts solely for betting.

- Never depositing bill money into betting accounts.

- Withdrawing winnings to separate savings accounts.

- Tracking betting finances completely separately from household budgets.

Some bettors treat betting accounts like separate business entities. All betting income and expenses flow through dedicated accounts. Personal finances remain completely untouched by betting activity. This clarity benefits both financial planning and performance analysis.

Long-Term Financial Planning with Betting Activity

Regular bettors who plan long-term often develop sophisticated financial structures. These systems account for betting as one component of broader financial pictures.

Emergency Fund Considerations

Financial advisors typically recommend 3-6 months of expenses in emergency savings. Bettors with regular activity often maintain this separate from betting bankrolls. Emergency funds stay completely untouchable regardless of betting outcomes.

Profit Allocation Plans

Bettors experiencing profitable periods face decisions about winnings. Common allocation strategies include:

- 50% withdrawn to savings or investments.

- 25% added to betting bankroll for larger bets.

- 25% used for personal enjoyment or rewards.

This prevents bankroll bloat while securing gains from successful periods. Different ratios work for different people based on financial goals.

Summary of Betting Financial Organization

Organized financial systems help regular bettors understand their actual activity and spending patterns. Record-keeping ranges from simple notebooks to sophisticated software, depending on personal preferences. Dedicated banking accounts separate betting from living expenses. Money management frameworks provide structure for bankroll decisions. Performance metrics reveal trends beyond simple wins and losses. Long-term planning integrates betting into broader financial pictures while maintaining clear boundaries.

Post Comment

Be the first to post comment!