Enterprises across fintech, e commerce, and digital entertainment are accelerating their deployment of AI risk engines as fraud threats intensify in 2026. Leaders see these systems as essential for navigating a landscape where deepfakes, synthetic identities, and large scale automated scams now blend into everyday payment activity. The shift is especially visible in organisations modernising their digital payment flows, where real time decisioning has become the expectation rather than an innovation.

Many platform operators have also begun rethinking how secure onboarding and payout experiences shape user trust. That conversation increasingly touches sectors where fast transactions and strict verification requirements converge, including digital entertainment platforms that manage high velocity payments. These expectations are evident at the casinos reviewed in cardplayer.com, where secure deposits, compliant onboarding, and reliable payment rails are assessed as core features. Businesses across industries are now taking similar cues as they rebuild payment stacks with AI first risk controls. This trend reflects a broader belief that secure digital payments can no longer rely on traditional rule-based systems alone.

AI Reshapes Payment Risk Decisions

AI-driven fraud has grown more sophisticated as generative tools make impersonation easier and faster to scale. Deepfake audio and video, synthetic identities seeded across multiple apps, and emotionally engineered multi channel scams increasingly bypass legacy fraud filters. These attacks push enterprises to develop models that evaluate behaviour over static credentials, enabling systems to detect anomalies even when attackers mimic legitimate customers convincingly.

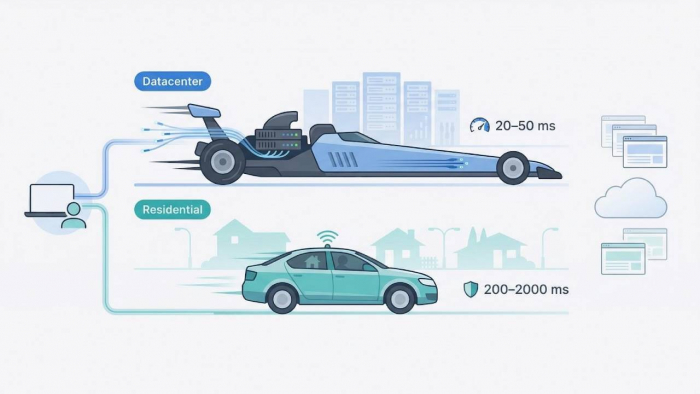

Payment method fraud has also emerged as a pressure point. According to the World Economic Forum, payment method based attacks have now overtaken ID document fraud, reaching a rate of 6.6%. This shift underscores how criminals are targeting financial flows rather than just personal documents. For payment providers and marketplaces, such trends necessitate risk engines capable of interpreting device, network, behavioural, and funding source signals in milliseconds.

This matters because digital commerce depends on reducing unnecessary friction without compromising safety. When AI engines can make accurate, instant decisions, users experience faster checkouts and fewer false declines, while businesses benefit from lower chargebacks and regulatory risk.

Fraud Models Expand Beyond Banking

Fraud risk used to centre heavily around banks and financial institutions, but the threat footprint has widened. Marketplaces, subscription platforms, creator economy services, and digital entertainment providers all face rising identity manipulation, account takeovers, and payment testing schemes. Each industry has its own incentive to strengthen verification without discouraging legitimate users.

Real time identity verification (IDV) systems are becoming central to this transition. Companies deploying AI powered document checks and biometric matching tools can now confirm identities while minimising manual review workloads. These capabilities reduce operational bottlenecks and provide stronger assurance that new users are genuine, even when attackers attempt to introduce synthetic personas pieced together from leaked data.

Strategic attitudes toward verification have shifted as well. Many enterprises now view identity verification as essential infrastructure rather than compliance overhead. A recent report confirmed that 22% of American companies plan to increase fraud prevention and IDV budgets by 50% or more. That level of investment signals a recognition that trust drives conversion, retention, and revenue — not just regulatory fulfilment.

Software Buyers Demand Explainability

As AI risk engines mature, software buyers are focusing on explainability. Companies want to understand how models reach their decisions, especially when a blocked payment or flagged identity can directly impact revenue or customer satisfaction. Explainability also supports internal governance, ensuring that compliance teams can justify actions taken by automated systems.

Many providers now expose granular risk insights through dashboards, surfacing indicators like behavioural anomalies, device fingerprints, or geolocation inconsistencies. This approach helps product teams calibrate thresholds that match their risk tolerance while preserving seamless user journeys. For regulated industries, explainability also simplifies audits by creating a clear link between model outputs and policy requirements.

Explainability is becoming a purchasing priority rather than a technical detail. Decision makers want tools that not only detect risk but also show their work. Vendors that fail to provide this transparency increasingly lose ground to AI platforms offering richer context and defensible automation.

What Enterprise Adoption Looks Like Next

Enterprise adoption of AI risk engines is set to broaden as digital payments become woven into more business models — from embedded finance to on demand services and creator monetisation platforms. Companies integrating these tools are beginning to standardise around a few key principles.

First, risk assessment should operate continuously rather than during isolated checkpoints. Behavioural risk scoring across the user lifecycle allows organisations to detect account changes, device shifts, or suspicious transaction patterns long after initial onboarding. This lifecycle approach reduces blind spots commonly exploited by attackers.

Second, organisations are adopting modular architectures that fit risk intelligence into their broader payment stacks. APIs powering KYC, AML screening, chargeback prediction, and account level monitoring are increasingly pulled together into unified decisioning layers. This consolidation reduces operational complexity and allows businesses to orchestrate consistent rules across markets.

Third, compliance teams aim to modernise without adding friction. AI tools that automate document inspection, run background checks in real time, and provide consistent risk scoring across regions help teams keep pace with growing regulatory expectations. As a result, compliance becomes less of a bottleneck and more of a growth enabler.

For technology leaders, the bigger picture is clear: payment security is no longer a defensive cost centre. It is emerging as a competitive advantage that shapes consumer trust, accelerates onboarding, and protects revenue at scale. AI risk engines sit at the heart of this shift, turning fragmented processes into a unified intelligence layer that supports safer, smoother digital transactions.

Enterprises that adopt these systems proactively are better positioned to manage both the complexity and the opportunity in modern digital payments — a landscape where speed, security, and trust now move together.

Post Comment

Be the first to post comment!