Disquantified.org is a financial literacy, investment insights, and money management-related blog platform. But what exactly does it offer, and how reliable is the information it provides? This article provides an in-depth examination of its content, purpose, and whether it delivers on its promises.

What Does Disquantified.org Do?

While the platform does not offer financial advisory services, it plays a crucial role in the personal finance, investing, and money management space by offering educational resources designed to help individuals make better financial decisions. Its primary focus is on publishing insightful articles, practical investment guides, and saving strategies tailored for readers who want to build long-term wealth through knowledge.

Operating primarily through its web-based blog, the platform also explores content syndication across social media channels to reach broader audiences interested in economic trends and financial literacy. For instance, in one of its featured articles, How to Create an Engaging Financial Report for Your Business, the platform demonstrates how even complex financial topics can be broken down into clear, actionable steps for everyday users.

In essence, the platform serves as a trusted educational hub, helping users stay informed and confident in their personal finance journey, without crossing into personalized financial advice.

Key Areas Covered by Disquantified.org

Personal Finance Fundamentals

Budgeting, savings, emergency planning & credit understanding.

Investing & Wealth-Building

Stocks, ETFs, real estate, mutual funds & long-term planning.

Online Income & Side Hustles

Freelancing, digital products, passive income & marketplace skills.

Financial Trends & Market Insights

Economic trends, industry shifts, and financial literacy updates.

Why Disquantified.org Is Gaining Popularity Among Gen Z Learners

In today’s gig economy, where student debt, inflation, and uncertainty define young adulthood, Gen Z is seeking financial clarity on their own terms—and Disquantified.org is emerging as a go-to entry point.

Here’s why:

- No financial jargon: The content is written in plain English, making it easy for 18–25-year-olds to grasp essential financial topics.

- Self-paced learning: Gen Z values independence, and the blog’s DIY structure aligns with their learning habits.

- Side hustle appeal: With a focus on monetization, online income, and creative entrepreneurship, it resonates with Gen Z’s digital ambitions.

- No gatekeeping: Everything is free, with no upsells or gated tools—unlike many traditional financial education platforms.

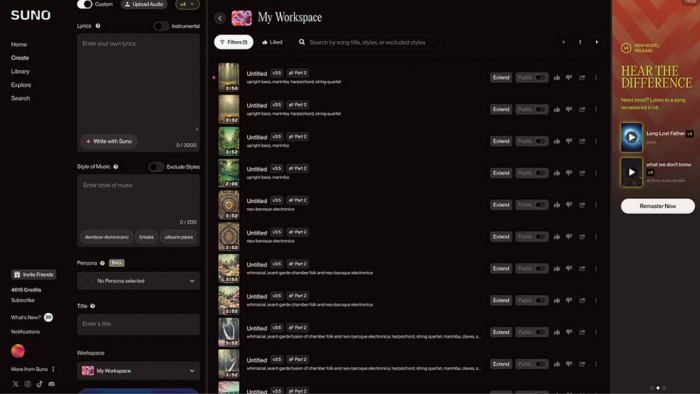

The blog’s tone is similar to approachable finance discussions seen in creator-focused analyses like Udio AI for Creators—informational, digestible, and friendly.

A Closer Look at the User Experience

A UI/UX examination (noted in independent evaluations like Spectra Engineering) highlights:

- Clean, fast-loading pages

- Mobile-optimized browsing

- Minimal visual clutter

- Easy navigation between finance topics

- Simple reading experience

Compared to platforms like Investopedia, Disquantified.org provides an easier learning curve for finance beginners

How Disquantified.org Uses Data Visualizations to Educate

Another standout feature? Visual learning.

- Instead of blocks of complex text, articles often use:

- Simplified pie charts to explain budgeting

- Timelines to show investment growth

- Infographics to compare financial products

This approach benefits visual learners and mirrors modern AI-based presentation styles found on platforms like Responde AI.

Turning Raw Data into Business Power

According to insights from a recent Vocal Media review, Disquantified.org’s real strength lies in converting abstract financial data into relatable, actionable insights. Whether you’re building a side hustle or starting your first business, the platform provides foundational knowledge that helps users understand how their money flows—and how to improve it.

It doesn’t just preach financial literacy; it enables it through bite-sized strategies and practical advice.

Strengths of Disquantified.org

- Diverse Topics in Finance: The site offers content covering multiple aspects of personal finance, making it a useful knowledge hub for beginners.

- Informational & Research-Based: The site provides how-to guides, strategic insights, and industry trends, helping users navigate complex financial decisions.

- Easy-to-understand Content: Unlike traditional finance websites that can be dense and jargon-heavy, Disquantified.org simplifies financial concepts for a general audience.

- Community Engagement & Discussions: The platform encourages discussions, allowing users to share financial strategies and learn from each other’s experiences.

Limitations of Disquantified.org

- Lack of Authoritative Sources: One major drawback is that articles often lack references to official financial institutions, reports, or accredited sources.

- Not a Financial Advisory Service: The site does not provide personalized financial advice, which means users still need professional consultation before making investment decisions.

- Repetitive Content: Some articles recycle common financial advice found on other blogs, with limited unique insights or exclusive research.

Comparing Disquantified.org to Other Finance Platforms

| Feature | Disquantified.org | Investopedia | NerdWallet | The Motley Fool |

| Financial Guides | Yes | Yes | Yes | Yes |

| Investment Analysis | Limited | Strong | Strong | Strong |

| Expert Opinions | Rare | Frequent | Frequent | Frequent |

| Accredited Sources | Not Always | Yes | Yes | Yes |

| Personal Finance Tools | None | Calculators | Loan Tools | Stock Picks |

Investopedia, NerdWallet, and The Motley Fool provide in-depth research, expert-backed articles, and interactive tools, Disquantified.org mostly remains an entry-level financial blog.

Is Disquantified.org Worth Your Time?

- If you're new to personal finance and need simple, digestible information, Disquantified.org is a good starting point.

- If you're looking for in-depth financial analysis, expert opinions, or investment calculators, you may need to look elsewhere.

- For readers who prefer casual financial discussions, Disquantified.org provides a community-based approach that can be engaging.

Conclusion

Disquantified.org is best viewed as a stepping stone into the world of personal finance—informative, approachable, but not authoritative. It simplifies financial concepts for beginners, offers a community-driven space for discussion, and covers a wide range of topics from budgeting to investment basics. However, its lack of accredited sources and limited expert analysis means it shouldn't be your sole resource for making high-stakes financial decisions.

If you're just starting your financial literacy journey, it's a great place to build confidence and curiosity. But if you're looking for data-driven insights, investment tools, or verified guidance, you’ll want to pair it with more established platforms.

In short: use Disquantified.org to learn the basics—graduate to others for the big moves..

FAQs

Q: Is Disquantified.org suitable for non-technical users?

A: Yes, its user-centric design and educational resources make it accessible to all skill levels.

Q: How does Disquantified.org protect my data?

A: The platform employs robust encryption, user-controlled privacy settings, and strict compliance with global data regulations.

Q: What are the costs?

A: Core features are free. Premium plans are in development for advanced needs 1.

Q: Where can I find tutorials?

A: Interactive guides and step-by-step walkthroughs are available within the platform’s educational hub.

Post Comment

Recent Comments

Aryan Patel

Apr 28, 2025I misstepped onto disquantified while looking for simple investment tips, and it’s been a pleasant experience. The articles don’t overwhelm you with complicated math or theories. I love that it’s completely free and still offers tools like retirement calculators. It’s like getting a financial basics workshop online without paying a penny. The site is easy to read even on mobile devices. The topics are updated decently, but could be even faster in some areas.

Oscar Moore

Mar 17, 2025Not a Finance Site!! This site feels more like someone’s personal blog than a real financial resource.

Diarmuid

Mar 12, 2025The content provides solid financial advice, making it a great starting point for beginners. While it covers familiar strategies but its still a helpful resource for those looking for straightforward guidance. 💡

Elio Moore

Mar 10, 2025The title seems like you’ll get valuable insights but the content doesn’t deliver. It’s just generic information that’s available everywhere else.

Joe Walsh

Mar 1, 2025When it comes to financial advice, accuracy matters, disquantified.org doesn’t provide enough proof to trust its content.

Ava Williams

Feb 28, 2025I like how this site presents financial topics in a way that doesn’t feel intimidating. It’s more like a conversation than a lecture, which makes learning easier 🙂

Liam Wilson

Feb 26, 2025It doesn’t offer much as compared to other finance platforms. There are no calculators, no expert interviews and nothing that makes it stand out. It’s just another basic finance blog.

Oliver Bennett

Feb 24, 2025This site is perfect for beginners. It does not overwhelm you with complicated terms and unnecessary details. The articles are clear and helpful.

Santiago

Feb 21, 2025Its a useful starting point for learning money management.

John Weekay

Feb 20, 2025This site explains things well. I have never been comfortable with finance. the articles make it easier to understand.

Rahul Parag

Feb 13, 2025Its too good for college students. I’m a student trying to learn more about personal finance, and this site has been helpful. The explanations are too simple and I don’t feel lost when reading. It’s a good place to start.

Greta Johansson

Feb 12, 2025I like how this site keeps things simple. It’s easy to read, and the discussions add value. this is a good option if you’re trying to learn personal finance without getting overwhelmed..

Daniel

Feb 11, 2025I regret spending time on Disquantified. The articles feel like copied versions of what’s already available online. They don’t cite official sources, so I don’t trust the information. If you’re serious about finance, other platforms are much better than this..

Harper Wilson

Apr 29, 2025Disquantified.org helped me break my fear of understanding personal finance. I liked how straightforward the articles are. Their budget and retirement tools give you a good first step into planning your finances. Some advanced areas like cryptocurrency or global market impact aren’t covered deeply, but that’s okay for beginners.