Table of Content

- 1. Introduction :

- 2. How Does Corporate Performance Management Work?

- 3. Why Corporate Performance Management Is Important for Businesses?

- 4. CPM Metrics to Track :

- 5. Key Decision Factors :

- 6. Comparison Table :

- 7. Sample Selection Scenarios :

- 8. Common Mistakes to Avoid :

- 9. Conclusion :

1. Introduction :

Corporate Performance Management (CPM) is a category of software and processes that helps organizations plan, measure, analyze, and optimize business performance. At its core, CPM connects strategy to execution by bringing together budgeting, forecasting, financial consolidation, reporting, and performance analytics in one structured system.

Choosing the right CPM solution matters because it directly influences how decisions are made. A poor fit can lead to slow reporting cycles, disconnected data, low adoption, and unreliable forecasts. A well-chosen CPM system, on the other hand, improves visibility, accountability, and confidence in both short-term decisions and long-term strategy.

2. How Does Corporate Performance Management Work?

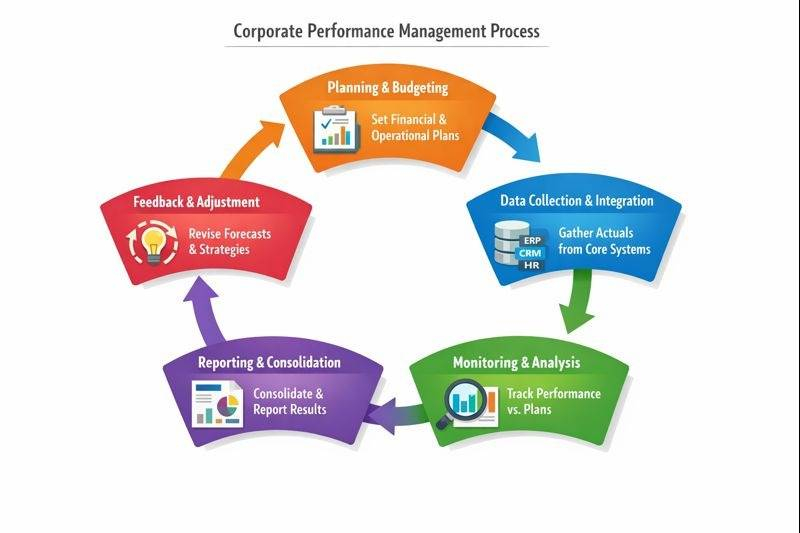

CPM works by creating a closed-loop performance process:

1. Planning & Budgeting-

Organizations define financial and operational plans based on goals, assumptions, and historical data.

2. Data Collection & Integration-

Actuals are pulled from core systems such as ERP, CRM, and HR platforms.

3. Reporting & Consolidation-

Results are standardized, consolidated, and reported for management and regulatory needs.

4. Feedback & Adjustment-

Insights feed back into revised forecasts, rolling plans, and strategic adjustments.

3. Why Corporate Performance Management Is Important for Businesses?

1) Aligns Daily Operations With Strategic Objectives-

Strategy often fails not because it’s wrong, but because teams don’t see how their day-to-day work connects to it. CPM links high-level goals to operational plans, budgets, and KPIs. This ensures departments are working toward the same outcomes, rather than optimizing locally in ways that don’t support the broader strategy.

2) Improves Forecast Accuracy and Financial Control-

Traditional annual budgets quickly become outdated. CPM enables rolling forecasts, scenario planning, and variance analysis, allowing finance teams to adjust assumptions as conditions change. This leads to better cash management, more reliable forecasts, and stronger control over costs and margins.

3) Reduces Manual Reporting and Spreadsheet Dependency-

Many businesses rely heavily on spreadsheets for planning and reporting. While flexible, spreadsheets are error-prone, difficult to audit, and hard to scale. CPM replaces manual consolidation and version control issues with standardized processes, saving time and reducing risk.

4) Enables Faster Response to Market Changes-

Markets change faster than reporting cycles. CPM shortens the time between what happens in the business and when leadership sees it. With timely dashboards and performance alerts, decision makers can respond quickly to demand shifts, cost pressures, or operational issues.

5) Increases Transparency and Accountability Across Teams-

CPM creates a shared view of performance. When goals, metrics, and results are visible, accountability improves. Teams understand what success looks like, how performance is measured, and where corrective action is needed.

What Happens Without CPM-

Without CPM, organizations often operate with disconnected tools, delayed reports, and inconsistent metrics. Decisions are made using partial or outdated information, planning cycles become slow and rigid, and leadership spends more time debating numbers than acting on them. Over time, this weakens decision quality and limits the organization’s ability to execute strategy effectively.

4. CPM Metrics to Track :

A strong CPM solution should support tracking across financial, operational, and strategic dimensions.

Common CPM metrics include-

1. Revenue growth and margin trends

2. Operating expenses vs budget

3. Cash flow and working capital

4. Forecast accuracy

5. Cost per unit or customer

6. Departmental performance KPIs

7. Strategic goal progress (OKRs or scorecards)

5. Key Decision Factors :

1) Business Goals Alignment-

A CPM system must support your specific planning and performance needs. Some organizations focus on financial consolidation, others on rolling forecasts or operational planning. Misalignment leads to unused features or missing capabilities.

2) Budget and Total Cost of Ownership-

Look beyond license fees. Include implementation, integrations, training, customization, upgrades, and ongoing support. A lower upfront cost can hide higher long-term expenses.

3) Scalability and Future Growth-

Your CPM should handle increased data volume, new entities, additional users, and more complex reporting as the business grows. Replacing a CPM system mid-growth is disruptive and costly.

4) Integration With Existing Systems (ERP, CRM, BI)-

CPM relies on accurate, timely data. Poor integrations result in manual work, delays, and data inconsistencies. Native or well-documented integrations reduce risk.

5) User Experience and Adoption-

If finance teams and business users find the system hard to use, they will revert to spreadsheets. Intuitive interfaces and role-based access drive adoption.

6) Reporting and Analytics Capabilities-

CPM should support standard financial statements, management reports, and ad-hoc analysis without heavy IT involvement.

7) Real-Time Data and Dashboards-

Near real-time visibility helps leaders act faster. Not all businesses need true real-time data, but delayed reporting should be a conscious trade-off.

8) Security and Compliance-

The system must support role-based access, audit trails, data encryption, and compliance with relevant standards and regulations.

9) Vendor Support and Training-

Strong onboarding, documentation, and responsive support reduce implementation risk and improve long-term value.

6. Comparison Table :

| Decision Factor | Typical High / Medium / Low Ratings | Notes |

| Cost | SMB: High value, Enterprise: Low value | Enterprise solutions are costlier but more robust |

| Scalability | Enterprise: High, SMB: Medium | Smaller tools may hit limits quickly |

| Integration depth | Enterprise: High | SMB tools may rely on manual imports |

| Ease of use | SMB: High | Enterprise systems may require training |

| Reporting flexibility | Enterprise: High | SMB tools focus on standard reports |

| Implementation time | SMB: Short, Enterprise: Long | Complexity increases setup time |

7. Sample Selection Scenarios :

Scenario A — Small Business With Limited Budget-

A small business typically operates with a lean finance team and limited IT support. The primary goal is control and visibility, not advanced analytics.

Key priorities:

● Low upfront and ongoing costs

● Simple budgeting and forecasting

● Fast implementation

● Minimal training requirements

For this type of organization, a lightweight CPM solution that covers core budgeting, basic forecasts, and standard financial reports is usually sufficient. Ease of use is critical—finance managers and business owners should be able to update budgets or view reports without relying on specialists.

Advanced features like complex consolidations or predictive modeling often add cost and complexity without delivering immediate value. The focus should be on replacing spreadsheets, improving accuracy, and gaining a clearer view of cash flow and performance.

Good fit when:

The business needs structure and consistency but does not yet face reporting complexity or rapid growth pressure.

Scenario B — Enterprise With Complex Reporting Needs-

Enterprises operate across multiple business units, legal entities, geographies, and currencies. Their CPM needs are driven by scale, compliance, and governance rather than simplicity.

Key priorities:

● Multi-entity and multi-currency consolidation

● Regulatory and statutory reporting support

● Strong data governance and audit trails

● Advanced analytics and scenario modeling

● Deep integration with ERP and data platforms

In this scenario, CPM is a strategic backbone rather than a reporting tool. The system must enforce consistent processes, support complex ownership structures, and provide reliable data for executive, board, and regulatory reporting.

Implementation timelines are longer, and user training is essential. Cost is a consideration, but it is outweighed by the need for accuracy, control, and scalability. A failure in reporting or compliance can carry significant financial and reputational risk.

Good fit when:

The organization requires standardized reporting across the enterprise and cannot tolerate data inconsistency or manual workarounds.

8. Common Mistakes to Avoid :

| Mistake | Impact | How to Avoid |

| Choosing based on price alone | Hidden long-term costs | Evaluate total cost of ownership |

| Ignoring user adoption | Low usage, spreadsheet fallback | Evaluate total cost of ownership |

| Underestimating integration needs | Data delays and errors | Validate integrations upfront |

| Overbuying features | Complexity without value | Focus on actual use cases |

| Weak change management | Slow ROI | Invest in training and rollout |

9. Conclusion :

Selecting the right CPM solution is a strategic decision, not a software purchase. The best choice aligns with business goals, scales with growth, integrates cleanly with existing systems, and is actually used by the people who depend on it.

Final guideline:

Choose the CPM that supports how your business plans, measures, and decides today, while remaining flexible enough for where the business is going next. Clarity, fit, and adoption matter more than feature count.

Post Comment

Be the first to post comment!