Table of Content

- What Is CrossMarket AI Really About?

- CrossMarket AI Claimed Features

- Who Owns and Operates CrossMarket AI?

- What Users Say About CrossMarket AI

- Can You Withdraw Money From CrossMarket AI?

- Is CrossMarket AI Legit or a Scam?

- Pros and Cons of CrossMarket AI

- Comparison With Legitimate AI Trading Platforms

- Final Verdict: My Experience With CrossMarket AI

- FAQs About CrossMarket AI

Why I Investigated CrossMarket AI

I’ve reviewed dozens of AI-branded trading platforms over the last few years. A recurring pattern keeps appearing:

- Heavy AI buzzwords

- Promises of high or “consistent” returns

- No regulatory disclosure

- Hidden ownership

- Withdrawal complaints

CrossMarket AI checked several of those boxes immediately, which is why I decided to investigate it thoroughly rather than dismiss it at first glance.

What Is CrossMarket AI Really About?

According to its promotional material, CrossMarket AI presents itself as an AI-powered trading system that scans:

- Cryptocurrency markets

- Forex

- Stocks

- Macro-economic signals

The platform claims to use “cross-market intelligence” to identify profitable opportunities that human traders supposedly miss.

The Problem

Despite these claims, the website provides:

- No whitepaper

- No technical documentation

- No explanation of models or data sources

- No proof of live trading infrastructure

What you mostly see is marketing language and a login prompt.

That lack of substance is a major credibility issue.

CrossMarket AI Claimed Features

1. Multi-Market Data Integration: Cross-Market AI pulls and processes data from multiple markets or platforms simultaneously such as stocks, crypto, commodities, social media sentiment, and customer behavior logs instead of focusing on a single silo.

2. Pattern Recognition Across Markets: Using machine learning, it identifies correlations and signals between markets that traditional tools might miss for example, linking commodity price movements with currency or stock shifts. These insights can help strategy planning and risk assessment.

3. Predictive Analytics & Trend Forecasting: The AI forecasts macro movements by analyzing vast datasets, helping users anticipate market changes and make more informed decisions (e.g., allocation of investment capital or marketing resources).

4. Real-Time Alerts & Signals: Many systems generate real-time trading or strategy signals based on cross-market behavior — accelerating decision cycles compared to manual analysis.

5. Automation & Efficiency: Tasks like data aggregation, analysis, pattern detection, and even strategy execution can be automated, saving time and reducing human error. This lets professionals focus on larger strategy instead of repetitive tasks.

6. Customer-Centric Insights (Beyond Financial Markets): In marketing and business use cases, Cross-Market AI can link customer behavior from social interactions to purchase history across channels, resulting in deeper segmentation and personalized campaign targeting.

7. Visual Dashboards & Decision Tools: Platforms often include intuitive dashboards that visualize complex relationships between markets, making it easier for traders or analysts to act on insights.

What Can Be Verified

None of the above features are independently documented

- No third-party audits

- No backtesting data

- No API disclosures

- No broker integration proof

In legitimate AI trading platforms, at least some of this information is publicly verifiable. Here, it isn’t.

Who Owns and Operates CrossMarket AI?

When I ran the domain through ScamAdviser, I found it was a newly registered site with private, hidden ownership. ScamAdviser gave it a moderate score but warned that the anonymity, use of proxy services, and recent registration all lower trustworthiness.

Meanwhile, Scam Detector’s analysis was even harsher, giving the platform a trust score of just 8.4/100, calling it high-risk and potentially unsafe.

If ownership is hidden and the platform isn’t transparent about its team, I immediately wonder, why would they hide if it’s a genuine product? This led me to check user reviews to see if real traders had better experiences.

How Does CrossMarket AI Claim to Work?

CrossMarket AI says it:

- Collects market data

- Processes it using AI

- Identifies opportunities

- Executes or recommends trades

This explanation is extremely generic. It mirrors hundreds of known scam platforms that reuse the same AI narrative without proof.

There is no demonstration of:

- Model training

- Risk management logic

- Market exposure limits

- Loss handling

Does CrossMarket AI Use Real AI, or Just Buzzwords?

The biggest issue is the lack of evidence that CrossMarket AI runs genuine AI models. There are no technical documents, code samples, or audits.

This aligns with what developers on Reddit often point out: many companies simply slap “AI” onto their name without real innovation. CrossMarket AI fits this description perfectly—lots of hype, but no tangible proof.

Since the company doesn’t show transparency, I looked at what actual users had to say.

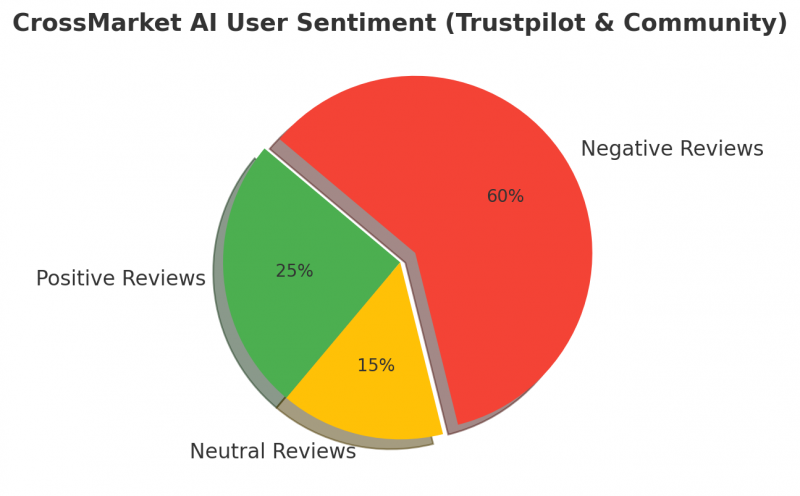

What Users Say About CrossMarket AI

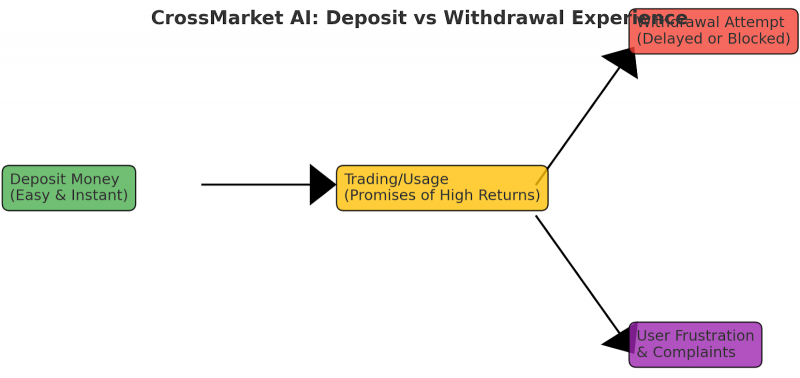

On Trustpilot, reviews are mixed and suspicious. A few glowing comments call it “the best trading tool,” but others outright label it a scam. The recurring complaint? Withdrawal problems, people could deposit money easily, but retrieving it was another story.

When reviews are polarized, either extremely positive or extremely negative, it’s often a sign of fake reviews mixed with genuine complaints. That pattern raised even more doubt for me.

This sentiment was echoed in trading communities, especially on Facebook.

Community Reactions: What Traders Discuss on Facebook

In trading forums and Facebook groups, many traders discuss whether CrossMarket AI is a scam. Several said they were lured by promises of guaranteed returns, but when they tried to withdraw, their accounts were locked or delayed indefinitely.

When communities start to doubt a platform and compare it to Ponzi-style schemes, it’s usually not a good sign. Which leads us to the question most people ask—can you actually withdraw money from CrossMarket AI?

Can You Withdraw Money From CrossMarket AI?

From the complaints I reviewed on Trustpilot and social media, the answer seems to be no—or at least not reliably. Many users reported deposits going through instantly, but withdrawals being delayed, rejected, or blocked.

This is one of the strongest indicators of a scam. A trading platform that restricts withdrawals is not protecting liquidity—it’s protecting itself at your expense.

This connects directly to another scam tactic: the promise of guaranteed high returns.

Why High-Return Promises Are Red Flags

The “too good to be true” pitch is central to platforms like CrossMarket AI. It promises easy wealth and AI-driven accuracy, but offers no proof.

Real-world examples confirm this danger. In one case reported by The Hindu, a man in Hyderabad lost ₹10 lakh after trusting an AI trading scheme that promised guaranteed returns.

Similarly, the California DFPI has warned that AI scams are on the rise, often preying on investors with promises of certainty in a market that is inherently uncertain.

That’s why I wasn’t just worried about money, I was also worried about security.

Security Risks: Malware and Phishing Concerns

It’s not only about losing deposits. Gridinsoft’s malware scan flagged CrossMarket AI as a potentially dangerous domain, raising risks of phishing, malware, or stolen personal data.

That means even visiting or logging in could put you at risk, not just financially, but also digitally.

With all these concerns piling up, I had to ask myself: is CrossMarket AI legit at all, or just another scam?

Is CrossMarket AI Legit or a Scam?

Based on:

- Hidden ownership

- No regulation

- No AI proof

- Withdrawal complaints

- Security warnings

- Community skepticism

CrossMarket AI exhibits multiple high-confidence scam indicators.

While not every user may lose money, the risk profile is extremely high.

Pros and Cons of CrossMarket AI

Pros

- Attractive AI-driven branding.

- Promises multi-market analysis.

- Some positive user reviews about ease of use.

Cons

- Hidden ownership, no regulation.

- Withdrawals often blocked.

- Scam warnings from watchdogs.

- Security concerns

- Strong community skepticism on Facebook.

The cons clearly outweigh the pros. Which naturally raises another important question: how does it compare to real, regulated AI trading platforms?

Comparison With Legitimate AI Trading Platforms

| Feature | CrossMarket AI | Regulated Platforms |

|---|---|---|

| Regulation | None | Yes |

| Ownership Transparency | Hidden | Public |

| AI Documentation | None | Partial / Verified |

| Withdrawals | Reported issues | Reliable |

| Legal Accountability | None | Enforced |

Examples of legitimate platforms:

- eToro

- Interactive Brokers

- Coinbase

What Are the Red Flags to Spot in Platforms Like This?

From my investigation, these are the red flags I now always look for:

- Hidden ownership or anonymous domains.

- Guaranteed high returns.

- Difficulty withdrawing funds.

- Malware or phishing warnings.

- No regulatory license.

CrossMarket AI ticks every single one of these boxes.

Final Verdict: My Experience With CrossMarket AI

After weeks of digging through reviews, scam detection tools, and regulatory warnings, I can confidently say CrossMarket AI is not a platform I’d trust. It follows the classic playbook of AI-based scams, hidden ownership, unrealistic promises, and withdrawal issues.

If you’re genuinely interested in AI trading, stick with regulated alternatives like eToro, Interactive Brokers, or Coinbase. They may not promise overnight wealth, but they won’t put your money, or your identity, at risk.

FAQs About CrossMarket AI

Where is CrossMarket AI based?

CrossMarket AI does not clearly disclose its headquarters or physical office, which makes its operations less transparent.

Does CrossMarket AI offer customer support?

The site claims to provide customer support, but users often report slow responses or no replies at all.

How does CrossMarket AI make money?

It likely profits from user deposits and trading fees, though the platform does not provide a clear revenue model.

Does CrossMarket AI have a demo account?

No official demo or trial account is available, making it hard to test the platform without depositing real money.

Can CrossMarket AI be trusted for long-term investing?

Given the lack of transparency, regulation, and negative reviews, it is not advisable for long-term investments.

Post Comment

Be the first to post comment!