China’s accelerating progress in artificial intelligence and advanced hardware is beginning to unsettle what many long viewed as America’s dominance in frontier technology. Analysts now warn that a so-called “China tech shock” is emerging, and it may only be in its early stages.

The shift reflects a deeper change in the global tech balance: China is no longer competing only on manufacturing scale or cost, but increasingly on core innovation.

What Analysts Mean by the “China Tech Shock”

TS Lombard economist Rory Green told CNBC that China has already broken the United States’ perceived monopoly on advanced technology and AI. In his view, the disruption is only beginning.

The significance lies in who is driving the innovation. For the first time, an emerging-market economy is operating at the cutting edge of science and technology rather than primarily serving as a low-cost production base.

That transition, if sustained, could reshape global tech competition over the next decade.

The Forces Behind China’s AI Acceleration

Several structural factors are powering China’s rapid progress.

Heavy policy support and funding

Beijing has stepped up national backing for AI development. Authorities recently launched a 60.06 billion yuan national AI fund, equivalent to about 8.7 billion dollars, alongside an “AI+” initiative designed to embed artificial intelligence across multiple sectors of the economy.

This coordinated push is helping Chinese firms scale research and deployment simultaneously.

Building a domestic hardware stack

China is also advancing its AI infrastructure despite export restrictions. Companies such as Huawei are developing large GPU-style computing clusters using domestically produced chips.

Access to relatively cheaper energy in parts of China further reduces compute costs, improving the economics of large-scale AI training and inference.

Model efficiency breakthroughs

Perhaps most disruptive has been the emergence of highly efficient Chinese models. Labs including DeepSeek have released frontier-level systems reportedly trained for under 10 million dollars using export-restricted hardware.

These results challenge a core assumption that only U.S. companies with top-tier Nvidia chips can compete at the frontier.

Why This Poses a Real Challenge to the U.S.

Analysts say the threat is not just about raw capability but about economics and global reach.

Cost-performance pressure

China is pairing near-frontier model performance with emerging-market cost structures. That combination could make Chinese AI infrastructure especially attractive to developing countries that prioritize affordability over geopolitical alignment.

The possibility of a China-centric tech sphere

Some observers believe the world could gradually split into competing technology ecosystems.

Under this scenario, many countries could choose lower-cost Chinese offerings across multiple layers, including:

- Huawei telecom networks

- Battery and solar supply chains

- AI cloud services

- RMB-linked financing

Over five to ten years, this could form what analysts describe as a “China tech sphere.”

Confidence in U.S. lead is weakening

Breakthroughs from companies like DeepSeek have already shaken the assumption of a permanent American advantage. On some benchmarks, Chinese models are now reported to match or exceed leading U.S. systems.

How U.S. Tech Giants Are Responding

American technology companies are not standing still. Major players including Amazon, Microsoft, Meta, and Alphabet have collectively signalled up to 700 billion dollars in AI-related capital expenditure plans.

However, that spending surge has introduced new investor concerns. Markets are increasingly questioning whether the massive infrastructure investments will deliver proportional long-term returns.

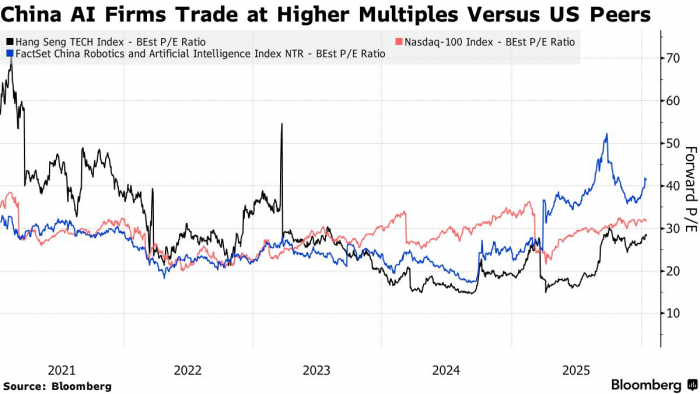

The result has been heightened volatility in tech valuations.

What Industry Leaders Are Watching Closely

Several near-term indicators will help determine how the competitive landscape evolves.

- Speed of capability convergence

Google DeepMind CEO Demis Hassabis has suggested Chinese AI could be only months behind top Western systems, a timeline that would significantly compress the innovation gap. - Adoption across the Global South

Infrastructure choices made by developing countries, especially in cloud, telecom, and AI services, will heavily influence whether a China-centric tech ecosystem takes hold. - U.S. policy response

Export controls, outbound investment rules, and domestic industrial policy will play a major role in shaping whether the rivalry stabilizes or splits into two largely separate technology stacks.

Bottom Line

China’s rapid advances in AI models, compute infrastructure, and national support mechanisms are beginning to challenge the long-standing assumption of U.S. technological dominance.

Whether this “China tech shock” becomes a lasting shift will depend on real-world adoption, continued model progress, and how aggressively the United States responds. But one thing is increasingly clear: the era of uncontested American leadership in advanced AI may be coming to an end.

Post Comment

Be the first to post comment!