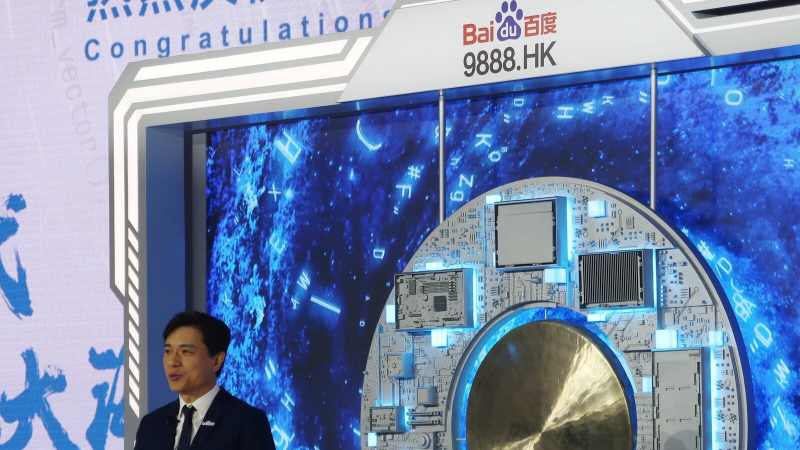

In a significant move that underscores China’s accelerating push for technological self-reliance, Baidu’s artificial intelligence chip unit, Kunlunxin, is preparing for an initial public offering (IPO) in Hong huKong. Fresh off a financing round that values the company at approximately 21 billion yuan ($2.97 billion), the tech giant’s subsidiary is positioning itself to become a cornerstone of the domestic semiconductor market.

Strategizing for Sovereignty in Silicon The timing of Kunlunxin’s public debut is strategic, aligning with Beijing’s broader directive to cultivate domestic alternatives to Western technology. As strictly enforced U.S. export controls limit access to advanced processors from market leaders like Nvidia, Chinese tech firms are increasingly turning inward. Kunlunxin has emerged as a critical player in this landscape, developing high-performance AI chips designed to fill the void left by foreign restrictions.

Separated from Baidu as an independent entity in 2021, Kunlunxin has rapidly matured from an internal R&D unit to a commercial powerhouse. While Baidu retains a controlling stake, the unit has successfully attracted external capital, including investment from a fund backed by China Mobile, signaling strong industry confidence in its roadmap.

Financial Trajectory and Market Ambitions Sources close to the matter indicate that Kunlunxin aims to file its listing application with the Hong Kong Stock Exchange as early as the first quarter of 2026, targeting a finalized IPO by early 2027.

The company’s financial health appears robust. After booking approximately 2 billion yuan in revenue for 2024, Kunlunxin projects a surge to over 3.5 billion yuan in 2025. This growth trajectory is expected to drive the company to a break-even point this year, a pivotal milestone for any hardware manufacturer.

Product Roadmap: The Era of the P800 and Beyond Central to this financial optimism is the P800, Kunlunxin’s latest generation chip, which has gained substantial traction in data center projects for state-owned enterprises and government bodies. Looking ahead, the company has an aggressive product release schedule:

- 2026: Launch of the M100, a next-generation chip focused on AI inference.

- 2027: Debut of the M300, a powerful processor capable of handling complex AI training tasks.

Market Reaction The capital markets have responded enthusiastically to the developments. Following reports of the IPO plans, Baidu’s shares in Hong Kong rallied, reflecting investor sentiment that the spinoff could unlock significant value for the parent company.

As the global race for AI dominance intensifies, Kunlunxin’s upcoming IPO represents more than just a financial listing; it is a litmus test for China’s ability to build a self-sustaining high-tech ecosystem in the face of geopolitical headwinds.

Post Comment

Be the first to post comment!