Digital fraud is no longer a peripheral risk handled quietly by compliance teams. It has become a central business threat—one that affects revenue, customer trust, regulatory standing, and brand reputation all at once. As commerce, finance, and customer engagement continue to move online, fraudsters have grown faster, more organized, and more technologically sophisticated. In response, businesses are entering an arms race where detection technology is no longer optional, but essential.

This shift marks a turning point. Fraud prevention used to rely on static rules, manual reviews, and post-incident investigations. Today, those methods struggle to keep up with the scale and speed of modern digital activity. Detection technology, powered by advanced analytics and machine learning, is becoming a core part of how organizations operate, protect themselves, and make decisions.

Why Digital Fraud Is Escalating So Rapidly

Digital fraud is expanding for a simple reason: opportunity. More transactions are happening online, more identities exist in digital form, and more systems are interconnected than ever before. This creates a broad attack surface that bad actors are eager to exploit.

Fraud is also no longer limited to obvious schemes like stolen credit cards. It now includes account takeovers, synthetic identities, refund abuse, loyalty program manipulation, insider threats, and sophisticated social engineering attacks. Many of these activities blend seamlessly into normal user behavior, making them difficult to detect with traditional controls.

Industry observers, regulators, and cybersecurity professionals broadly agree that fraud has shifted from isolated incidents to persistent, adaptive campaigns. In this environment, businesses that rely on outdated detection methods are not just vulnerable—they are predictable targets.

The Cost of Fraud Goes Beyond Financial Loss

While direct financial losses are significant, they represent only part of the true cost of fraud. When fraud incidents occur, businesses often face a cascade of secondary consequences.

Customer trust erodes quickly after a breach or fraudulent transaction, especially if personal data is involved. Regulatory scrutiny can intensify, leading to fines, audits, and mandatory reporting obligations. Internal teams may be diverted from growth initiatives to damage control, legal response, and remediation efforts.

Perhaps most damaging is the long-term impact on brand credibility. In competitive digital markets, reputation is an asset that takes years to build and moments to lose. Fraud detection technology plays a crucial role in protecting that asset by reducing both the frequency and severity of incidents.

Why Traditional Fraud Controls Are Falling Short

Many organizations still rely on rule-based systems that flag activity based on predefined thresholds or known fraud patterns. While these systems can catch basic fraud, they struggle with new or evolving tactics.

Fraudsters study these rules and adapt their behavior to stay just below detection limits. As a result, static controls often generate large volumes of false positives while still missing high-risk activity that does not match historical patterns.

Manual Review Does Not Scale

Human review remains important, but it cannot scale to meet the demands of high-volume digital environments. As transaction volumes grow, manual processes become slower, more expensive, and more prone to inconsistency.

This creates a difficult trade-off: either tighten controls and frustrate legitimate customers, or loosen them and accept higher fraud losses. Detection technology aims to eliminate this compromise by improving accuracy and speed simultaneously.

How Modern Detection Technology Changes the Game

Modern fraud detection systems use machine learning to analyze patterns across vast datasets. Instead of focusing on individual transactions in isolation, these systems evaluate behavior over time, across devices, locations, and interaction histories.

This approach allows detection models to identify subtle anomalies—such as unusual navigation paths, timing patterns, or account behavior—that would be invisible to traditional tools. Importantly, these models can adapt as fraud tactics evolve, learning from new data rather than relying solely on past rules.

Real-Time Risk Scoring

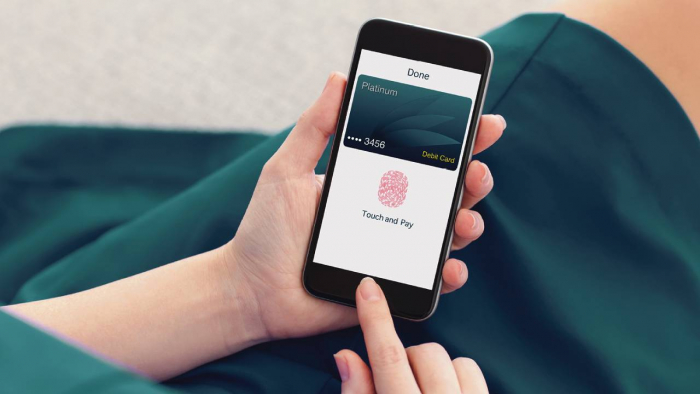

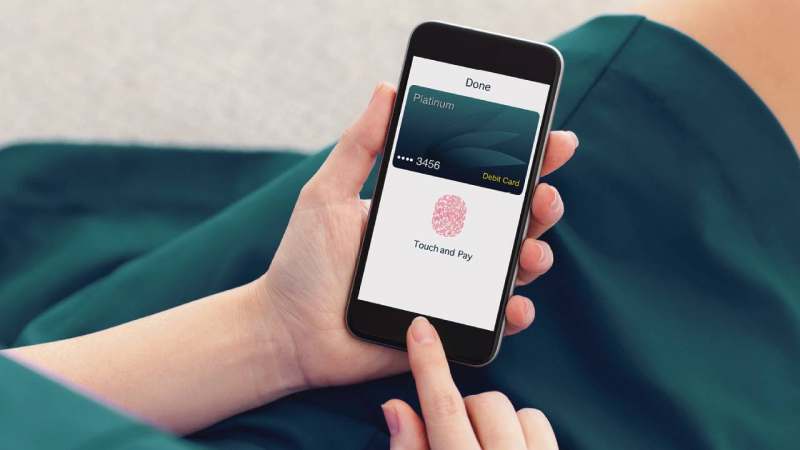

Speed matters in fraud prevention. Detection technology now enables real-time risk scoring, allowing businesses to evaluate transactions or actions as they occur.

High-risk activity can be challenged, delayed, or blocked immediately, while low-risk interactions proceed smoothly. This precision reduces friction for legitimate users while concentrating security measures where they are most needed.

Cross-Channel Visibility

Fraud rarely occurs in a single system. Modern detection platforms integrate data across payment systems, user accounts, customer support interactions, and external signals. This holistic view supports more informed decisions and prevents attackers from exploiting gaps between departments or platforms.

As a result, fraud detection software is increasingly viewed as an enterprise-wide capability rather than a siloed security tool.

Detection Technology as a Strategic Business Asset

Forward-thinking organizations are reframing fraud detection from a defensive expense into a strategic investment. Effective detection technology enables businesses to grow with confidence, enter new markets, and offer digital services without assuming unacceptable risk.

For example, improved fraud detection can support faster customer onboarding, smoother checkout experiences, and expanded digital offerings. Instead of imposing blanket restrictions, businesses can tailor controls based on real-time risk, improving both security and user satisfaction.

This alignment between protection and growth is a key reason detection technology is moving into executive-level conversations.

Conclusion

The fight against digital fraud is accelerating, and the stakes are rising. As fraud tactics grow more sophisticated and persistent, businesses can no longer rely on reactive measures or outdated controls.

Detection technology has become a business imperative—one that protects revenue, preserves trust, and enables sustainable digital growth. Organizations that invest early and thoughtfully will not only reduce losses but also gain a competitive advantage in an increasingly complex digital economy.

In the arms race against fraud, standing still is not a neutral position. It is a risk. Businesses that embrace modern detection capabilities are choosing resilience, precision, and long-term confidence in a world where digital trust matters more than ever.

Post Comment

Be the first to post comment!