Most articles about AI in accounting start with tools. This one starts with a workday.

Imagine two finance teams handling the same volume of transactions in 2026. Both are compliant. Both close the books on time. One team spends its day fixing errors, reconciling mismatches, and chasing approvals. The other spends its time reviewing forecasts, advising leadership, and stress-testing decisions before money moves.

The difference is not headcount or budget. It is how AI is embedded into accounting and finance workflows, and where its limits are respected.

This article examines AI in accounting and finance through a practical lens: what it actually does today, where it creates measurable value, and where it introduces real risks. Every benefit and challenge below is grounded in documented use cases, regulatory reality, and verified outcomes.

A Map, Not a Buzzword: Where AI Actually Operates

AI in accounting and finance does not exist as a single system. It operates across four functional layers, each with different benefits and risks.

Layer 1: Data Ingestion and Classification

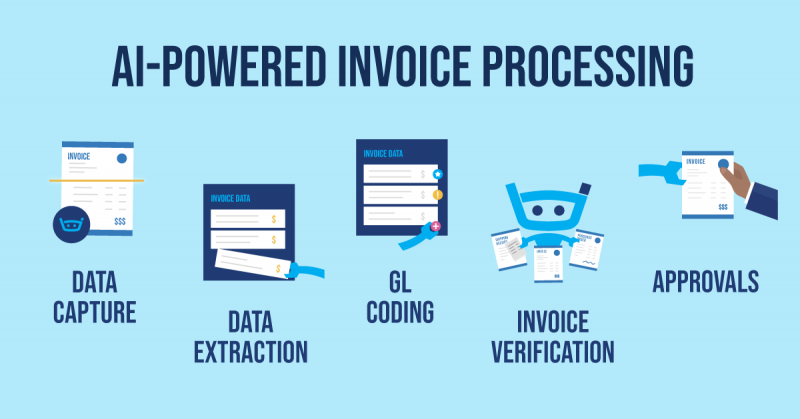

This is where AI adoption is most mature.

AI systems use optical character recognition (OCR) combined with machine learning to extract data from invoices, receipts, contracts, and bank statements. Modern systems achieve 93 to 98 percent extraction accuracy on structured and semi-structured documents, according to multiple AP automation benchmarks.

This layer supports invoice and receipt capture, automatic general ledger coding based on historical patterns, matching invoices to purchase orders and receipts, and categorizing bank transactions. Because errors at this stage propagate downstream, data quality and validation remain foundational.

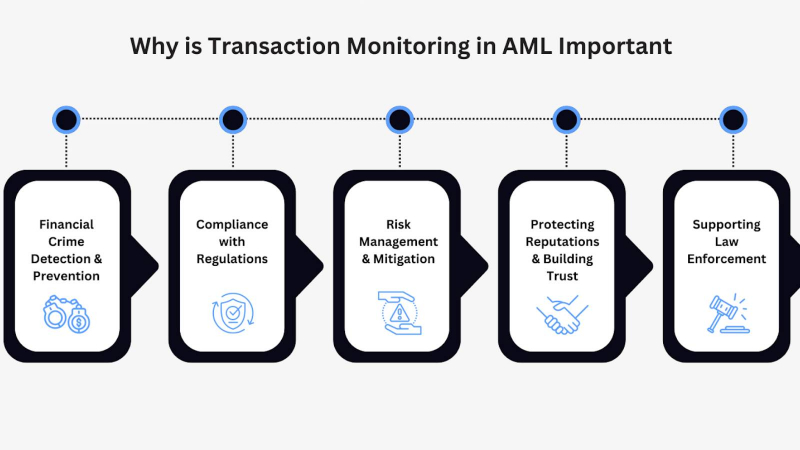

Layer 2: Transaction Monitoring and Controls

This layer focuses on risk and compliance, not speed.

Machine learning models continuously analyze transaction behavior to flag anomalies such as duplicate invoices, unusual payment timing, amounts that deviate from vendor history, or suspicious changes to banking details. Unlike static rule-based systems, these models adapt as transaction patterns evolve. However, they are probabilistic rather than deterministic. Every alert still requires human judgment, especially in regulated environments where false positives carry real operational cost.

Layer 3: Analysis, Forecasting, and Decision Support

This is where AI begins to change how finance teams think, not just how they process.

Predictive models analyze historical and real-time data to support cash flow forecasting, spend trend analysis, credit risk modeling, and portfolio stress testing. Unlike traditional forecasting cycles that refresh monthly or quarterly, AI-driven forecasts update continuously. This allows finance leaders to respond to volatility with data rather than instinct, particularly in environments where liquidity and exposure change rapidly.

Layer 4: Communication and Interpretation

This is the newest and least mature layer.

Natural language processing enables systems to summarize financial reports, answer questions about variances, and extract insights from regulatory filings or contracts. While this increases accessibility to financial data, it also introduces the highest risk of misinterpretation, particularly when outputs are consumed without validation. Most organizations treat this layer as assistive rather than authoritative.

What AI Does Better Than Humans, With Evidence

In accounts payable, AI-driven invoice processing has consistently reduced handling time by up to 75 percent, according to enterprise case studies across manufacturing, retail, and professional services. These gains do not come from raw speed alone. They result from eliminating manual data entry, reducing exception queues, and preventing rework caused by inconsistent classification.

Machine learning systems also reduce data entry and categorization errors by up to 90 percent in high-volume environments. This does not mean AI is flawless. It means it applies the same logic consistently. Humans vary under pressure and fatigue. Models do not, though they will reproduce historical mistakes unless corrected.

Fraud detection is where AI delivers value that humans cannot replicate. Models identify subtle correlations across thousands or millions of transactions, detecting behavioral shifts that do not violate explicit rules but deviate from historical norms. In finance, firms such as BlackRock use AI platforms like Aladdin to simulate portfolio risk under multiple market scenarios, supporting decision-making during periods of extreme volatility.

Another structural advantage is forecasting. Traditional forecasting is periodic and static. AI-driven forecasting is continuous, updating projections as new data enters the system. This materially improves liquidity planning, credit exposure management, and vendor payment optimization compared to spreadsheet-based approaches.

The Benefits, Quantified and Bounded

Across accounting and finance functions, AI delivers value in ways that are measurable and operationally visible, not abstract. The most immediate benefit is cycle time reduction. Invoice processing, reconciliations, and transaction matching that once took days can now happen continuously, shrinking close cycles and reducing end-of-period pressure. This does not just save time. It lowers overtime costs, reduces burnout, and improves consistency during peak reporting periods.

Accuracy improvements come from standardization, not intelligence. AI applies the same classification logic across thousands of transactions without drift. In high-volume environments, this sharply reduces rework caused by inconsistent coding, duplicate entries, or missed accruals. Fewer downstream corrections also mean fewer audit adjustments and cleaner handoffs between accounting, FP&A, and compliance teams.

Risk management benefits are more subtle but often more valuable. Continuous transaction monitoring allows organizations to detect anomalies earlier, before payments clear or errors cascade into financial statements. This shortens the window between issue creation and issue response, which directly reduces financial exposure.

Perhaps the most strategic benefit is capacity reallocation. When AI handles ingestion, matching, and first-pass analysis, finance professionals spend less time fixing errors and more time reviewing exceptions, modeling scenarios, and advising decision-makers. The work shifts from reactive to interpretive. Importantly, this does not remove judgment. It concentrates judgment where it has the highest impact.

Where AI Creates Real Problems

In real deployments, the biggest challenges are not theoretical. They are operational.

Data privacy and security risks increase as AI systems centralize sensitive financial information and rely on third-party integrations. Payroll data, vendor bank details, tax records, and contracts often flow through multiple systems before reaching a model. In practice, many organizations struggle to maintain clear data lineage, access controls, and audit trails across this chain. When a regulator asks how a decision was made or who accessed what data, incomplete answers become a compliance liability.

Bias is not an abstract concern in finance. Models trained on historical credit decisions, audit flags, or vendor performance data often inherit the assumptions embedded in those outcomes. This can skew risk scoring, prioritize the wrong audits, or unfairly flag certain counterparties. Addressing this requires ongoing bias testing, documentation, and retraining, which adds operational overhead and slows rollout.

Legacy system integration remains one of the most common failure points. Many accounting platforms were built for deterministic rules and batch processing, not probabilistic models and continuous data flows. AI projects often stall not because the model fails, but because upstream data is fragmented, poorly structured, or locked inside systems that were never designed to talk to each other.

Explainability creates friction at scale. Even when models perform well, finance teams must justify outputs to auditors, regulators, and internal stakeholders. If a system cannot clearly explain why it flagged a transaction or changed a forecast, teams often override it or abandon it entirely. Accuracy without defensibility is rarely usable in regulated environments.

Finally, workforce disruption shows up quietly. When AI changes workflows without retraining staff, teams may misuse tools, distrust outputs, or bypass systems entirely. Organizations that succeed treat AI adoption as a change management exercise, not a software rollout. Those that do not often see adoption stall despite significant investment.

Real-World Use Cases, Not Hypotheticals

In practice, organizations that succeed with AI share a common pattern. A mid-sized accounting firm using AI-driven accounts payable automation reduced invoice processing time by 75 percent and reassigned staff to advisory work. Goldman Sachs applies AI to market data analysis to support trade execution and risk management, reducing manual intervention. EY uses AI-based audit platforms to analyze entire ledgers rather than samples, expanding fraud detection coverage.

What connects these examples is not the technology itself, but the fact that AI is embedded into workflows rather than bolted on.

Regulation Is Not Slowing AI. It Is Shaping It

Emerging regulatory frameworks such as the EU AI Act and updated financial risk standards emphasize transparency, auditability, and human oversight. This environment favors narrow, explainable models over general-purpose systems in high-risk financial functions. Organizations that treat regulation as a design constraint rather than an obstacle deploy AI more sustainably and with fewer reversals.

The Future Is Hybrid, Not Autonomous

Looking ahead, AI will not replace accountants or finance professionals. It will redefine where judgment matters most. Continuous auditing will increasingly replace periodic audits. Predictive cash management will become a default expectation. Reporting will be AI-assisted but require mandatory human validation. Accounting, finance, and data science roles will converge further.

The most effective teams will not ask whether AI can do the work. They will ask where human judgment adds the most value once AI handles the rest.

Final Perspective: Power With Boundaries

AI in accounting and finance is neither a silver bullet nor a threat. It is a force multiplier.

When applied to data-heavy, rule-driven processes, it delivers measurable efficiency and accuracy gains. When applied without governance, explainability, or workforce readiness, it introduces new categories of risk.

The organizations that succeed with AI will not be the ones that adopt it the fastest. They will be the ones that adopt it deliberately, with clarity about what AI should do, what it should never do, and where human expertise remains irreplaceable.

That balance, more than any algorithm, will define the future of accounting and finance.

Post Comment

Be the first to post comment!