Table of Content

- By the Numbers: Growth, Traffic & Revenue

- Global Reach & India’s Rapid Expansion

- The Mobile Shift: How Planning Actually Happens

- Tools That Users Value Most

- AI and Algorithmic Travel Planning

- Competitive Landscape: Where Skyscanner Fits

- What Travellers Actually Say: Reviews & Real-World Feedback

- Legal & Transparency Considerations

- Industry Outlook 2025–26: What to Expect

- Quick FAQs

- Takeaway: What the Data Really Tells Us

The way people plan travel has changed more in the past five years than in the previous two decades. We compare more, decide faster, and rely heavily on apps to find the best deals. One name that keeps surfacing in that conversation is Skyscanner.

It’s not an ad or a pitch, just an observation. The platform has become almost impossible to ignore in the global travel search space. But what exactly explains its rise? Are its claims about trust and transparency justified? And how do users actually feel about it?

Let’s check what the numbers, reviews, and market data really say about Skyscanner.

By the Numbers: Growth, Traffic & Revenue

Reports suggest that Skyscanner’s user base reached around 110 million monthly active users in 2025, with a total annual reach of 200 million+ travellers. The website handled 2.9 billion sessions, reflecting a 33 per cent year-over-year increase.

Financially, flight-commission revenue rose from £223 million to £271 million, while the app crossed the 100 million download mark by mid-2025.

These figures support the claim that Skyscanner remains one of the most-visited travel-search platforms globally, though not all of that engagement translates directly into revenue.

Global Reach & India’s Rapid Expansion

Travel demand has rebounded sharply in emerging markets, and India is leading the trend. Data shows that Skyscanner’s traffic and revenue in India grew 35–40 per cent year over year. Roughly two-thirds of Indian travellers plan to take more trips in 2025, most of them cultural or international.

Skyscanner’s mobile-first interface seems to fit this momentum — quick, app-driven, and ideal for users comparing options on the go.

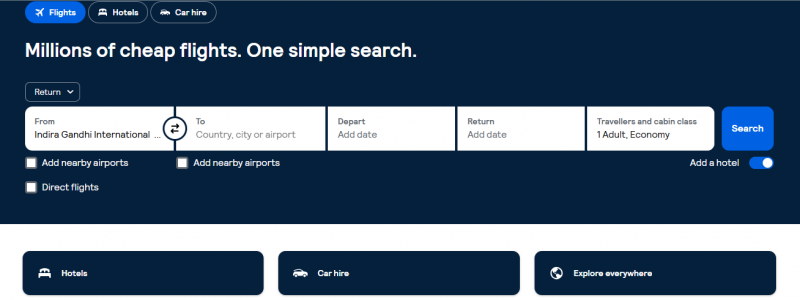

The Mobile Shift: How Planning Actually Happens

If we suppose that mobile travel planning defines modern tourism, Skyscanner is a clear example. The app handles everything from multi-city booking to fare tracking, and younger travellers (Gen Z) now rely heavily on mobile for flexibility and instant alerts.

Skyscanner claims that over half of its users trust its AI-powered suggestions, from predictive fares to personalised trip ideas. Whether or not users agree with that number, mobile clearly sits at the heart of its growth.

Tools That Users Value Most

Skyscanner’s draw lies in its flexibility. Features like “Everywhere” search, cheapest month, and price alerts make it easy to plan without fixed dates. Independent analyses often rate Skyscanner among the top tools for advance-purchase fares (alongside Skiplagged), but more average for last-minute bookings.

AI and Algorithmic Travel Planning

AI now shapes how travellers search. According to company data, 54 percent of global users feel comfortable letting digital tools guide their booking decisions, compared with 47 percent last year.

Skyscanner’s algorithm analyses routes, seasonal trends, and fare volatility to predict cheaper windows and new destination patterns. The benefit is convenience; the concern is transparency — few users know how much the AI is steering their options.

Competitive Landscape: Where Skyscanner Fits

The online travel ecosystem in 2025 is dominated by giants like Booking.com (≈69 % share) and Expedia (≈11.5 %), while Skyscanner acts as a metasearch aggregator, helping users compare across dozens of airlines and agencies.

| Platform | Market Share (2025) | Key Strengths | Limitations |

| Booking.com | ~69 % | Broad inventory, UX design | Uneven customer support |

| Expedia | ~11.5 % | Bundled packages, loyalty | Response delays |

| Skyscanner | Aggregator (N/A) | Flexible filters, global coverage | No direct booking; ghost fares possible |

| Kayak | Metasearch (N/A) | Fare forecasts, “Hacker Fares” | Depends on partner reliability |

Skyscanner’s independence from direct booking gives users choice, but also shifts responsibility, refunds and customer care come from whichever provider you choose after clicking through.

What Travellers Actually Say: Reviews & Real-World Feedback

Before judging the claims, let’s check what users report across different review sites:

- Trustpilot – Over 20,000 reviews average 4.4 stars, praising ease of use and global search coverage.

- Sitejabber – Ratings hover near 1.5 stars, with complaints focused on unreliable third-party sellers rather than Skyscanner’s interface.

- Reddit Forums – Travellers often describe it as “a search engine, not a booking site” and advise verifying the final vendor before payment.

The divide between ratings confirms a consistent pattern: users like Skyscanner’s tools but blame partner agencies for poor experiences. For accurate interpretation, reviewers should distinguish between Skyscanner (the search layer) and the sellers it redirects to.

Legal & Transparency Considerations

Some regulators have urged greater clarity about pricing and partner listings. Skyscanner has introduced disclaimers noting that “prices may change based on availability” and “booking is handled by external providers.”

From a quality-assurance perspective, this transparency is an improvement, but ghost-fare visibility and delayed updates remain occasional issues reported by users.

Industry Outlook 2025–26: What to Expect

Analysts forecast that 83 percent of travellers worldwide plan as many or more trips in 2026 than in 2025. In India and Southeast Asia, experience-driven and cultural travel are expected to keep expanding.

If that holds true, Skyscanner will likely stay central in trip-planning discussions — not necessarily as the only option, but as a consistent starting point for comparing value.

Quick FAQs

Is Skyscanner safe to use?

Yes, for searching and comparing flights. Payment occurs on external sites, so check each provider’s policy.

Does Skyscanner charge fees?

No. It earns through referral commissions from partner sites.

Why do prices sometimes change?

Because fares update frequently across airlines. What you see may differ slightly once you click through.

Is Skyscanner better than Google Flights?

It depends, Skyscanner is stronger on flexible searches (Everywhere, cheapest month), while Google Flights shines in refund tracking and carbon-emission data.

Takeaway: What the Data Really Tells Us

Skyscanner’s 2025 story isn’t about dominance; it’s about adaptation. It proves that people want speed, visibility, and control when they travel, even if that means relying on aggregators rather than booking directly.

- For travelers, the smart approach is simple:

- Use Skyscanner to explore and compare.

- Double-check the booking site’s legitimacy.

- Don’t chase the lowest fare blindly, reliability matters just as much.

That balance between freedom and caution will define how we all travel in 2026 and beyond.

Post Comment

Be the first to post comment!